It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

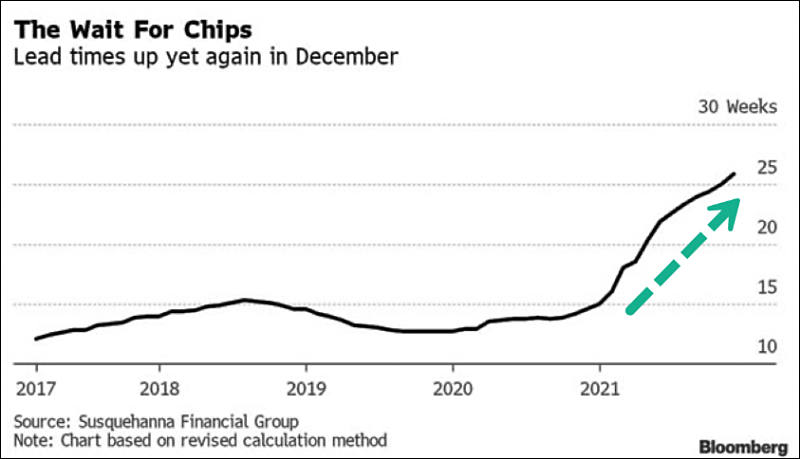

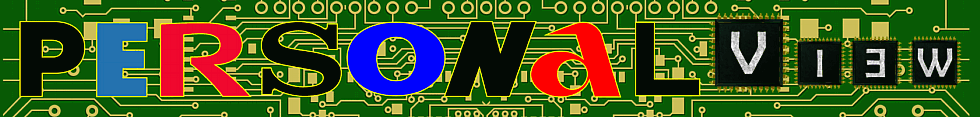

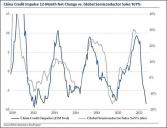

Semiconductor sales strongly correlate with credit growth in China

sa18761.jpg530 x 406 - 35K

sa18761.jpg530 x 406 - 35K -

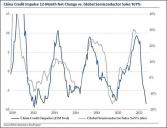

TSMC 5nm capacity distribution

It shows that Apple devices and Quallcomm LSI have huge margins.

AMD and Nvidia products presented here are their professional lineup GPUs and chips made for supercomputers. Also with huge margins.

sa18834.jpg790 x 491 - 34K

sa18834.jpg790 x 491 - 34K -

TSMC has kicked off pilot production of chips built using N3 (namely 3nm process technology) at its Fab 18 in southern Taiwan, and will move the process to volume production by the fourth quarter of 2022, according to industry sources.

-

Worldwide sales of semiconductors are poised to increase 25.6% on year to a record high of US$553 billion in 2021, according to the Semiconductor Industry Association (SIA), which quoted a newly released WSTS industry forecast as saying.

In 2022, the global market is projected to post moderate growth of 8.8% to reach US$601.5 billion in annual sales, SIA indicated.

In reality few developed countries performed dirty trick with just hugely increasing their margins on all semiconductors, including very old processes.

-

Vertical Transport Field Effect Transistors (VTFET)

-

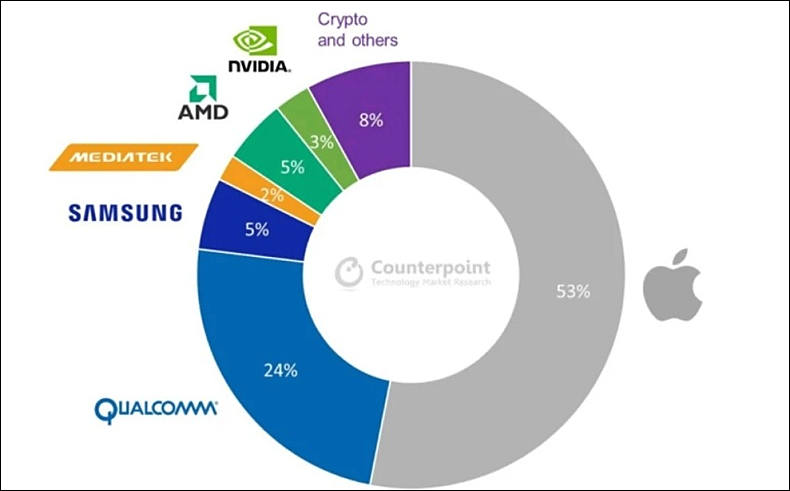

By the end of the current year, the value of capital expenditures in the industry may grow by 34% to a record $ 152 billion. Before that, they increased by 41% in 2017, but mainly due to memory manufacturers. This year, contract chip manufacturers will take the lead, assuming 35% of core costs.

sa19054.jpg543 x 430 - 54K

sa19054.jpg543 x 430 - 54K -

TSMC is expected to kick off commercial production of chips built using more-advanced 3nm process technology in the fourth quarter of 2022, with the initial capacity to be equally shared by Apple and Intel.

-

The revenue of semiconductor suppliers increased by 26% to $ 553 billion, but the trend will not lose its relevance this year, since the amount of revenue in this segment will exceed $ 600 billion for the first time, according to analysts at Euler Hermes. There are still some risks for the semiconductor industry that will prevent a 9% increase in revenue.

-

Industry analysts agree that a fortunate set of circumstances, such as multiple cartel agreements, will allow Samsung Electronics to break its operating profit record for the last quarter. The corresponding figure could reach $ 12.7 billion, 68% higher than the result of the same period in 2020.

-

The Dutch company ASML, a monopoly in the lithographic scanner market for semiconductor manufacturing, has updated information on the fire at its Berlin plant. There are no final conclusions on the incident yet, they will be made public later, but the main thing has already been clarified and this makes us worry about the pace of transition to the latest technical processes. The fire partially damaged the production sites for the manufacture of equipment for the EUV range scanners.

In terms of the production of components for EUV scanners, the fire affected part of the production area for the manufacture of silicon wafer holders in EUV installations. This section has not yet been restored and returned to work. Plans to minimize damage to scanner manufacturing and local customer service are being developed.

The company hopes to provide additional information about the incident on January 19 during the announcement of the results of the previous quarter. As this will affect ASML production plans for the new 2022, comprehensive information should be expected.

https://www.asml.com/en/news/press-releases/2022/update-fire-incident-at-asml-berlin

-

Taiwanese company TSMC is due to report its quarterly financial results this week, but December statistics have already been released. It suggests that the company ended the last three months with an increase in revenue by 21% to a record $ 15.8 billion. According to experts, this year the company's revenue will grow by 26%.

Destruction of all semiconductors corporations with their greedy cartel games became total necessity.

-

It will take at least six months for Advantest to deliver its high-end SoC testing equipment as shortage of key chip components needed to power the equipment has constrained the company's production, according to Alex Wu, chairman and president of Advantest.

-

This year, TSMC intends to increase capital expenditures by at least a third of last year's level, to $40-44 billion. Management forecasts that TSMC will increase revenue by 15-20% annually in the coming years, while the profit margin will rise to at least 53% . The need to spend more will not undermine the profitability of the business.

-

The development of new technologies will require new personnel, and someone has to work at newly created enterprises. TSMC's engineering staff will increase by 8,000 this year, MediaTek is going to hire 2,000 engineers.

This is reported by the Japanese edition of the Nikkei Asian Review, citing informed sources. Last year, TSMC hired about 8,000 people, so this year's hiring plans will ensure that the pace of staff growth continues. Now TSMC has about 60,000 employees worldwide, although the bulk of the workforce is concentrated in Taiwan.

In the case of MediaTek, which develops mobile processors, the engineering staff is expected to increase by 2,000 this year. In the past, the company has hired about the same number, and in total, 19,300 people work for the benefit of MediaTek. In addition to staff in Taiwan, this developer will attract talent from within India. About 1,000 specialists in the field of research and development are already working here.

-

TSMC invests roughly 50% of its revenue in equipment compared to Samsung's 70%. Samsung announced it will begin mass production using its 3nm process in the first half of 2022, overtaking TSMC. However, even if they are unable to overtake TSMC's market share in the short term, taking the initiative to announce mass production using the 3nm process is a strategic move. The announcement proves Samsung is working diligently to reach its goal of becoming the world's number one system semiconductor maker by 2030.

-

Capitalism as case of shortages

Semiconductor shortage problems will persist until at least mid-2022, as industry players try to stock up to normal levels but do not invest in mature technology, research firm IDC said.

The company believes that one of the reasons for this situation is too little investment in non-advanced technological processes - they are necessary in the production of vital components for the automotive industry and other market segments. According to IDC, the market for semiconductor products is still in short supply of products that are produced on "obsolete" equipment. We are talking about technical processes of 40 nm or more - they are involved, for example, in automotive electronics, LCD controllers and power management.

Last year, up to 67% of semiconductor products were manufactured using such technologies, rather than advanced solutions at 16 nm or less. Products based on the most advanced technologies account for only 15% of wafer shipments, but they generate 44% of total revenue. In this regard, advanced productions receive more significant investments in comparison with mature solutions.

This guys aim for profit, not real needs.

-

Its a treason then

A shortage in the supply of semiconductors has led to an increase in the cost of purchasing chips among original equipment manufacturers (OEMs). They had to spend 25.2% more than a year earlier. It follows from the report of analytical agency Gartner.

Gartner's list of the top 10 semiconductor spenders in 2021 is topped by Apple and Samsung. The former accounted for nearly 12 percent of global chip purchases in 2021. The company spent $68.269 billion on the purchase of chips. The South Korean giant spent $45.775 billion on the purchase of chips. In percentage terms, Samsung increased its chip spending by 28.5% compared to 2020.

-

As I said before - people will pay now to greedy basters from their taxes

Not having managed to do this before the end of last year, members of the US Congress this week nevertheless voted for the adoption of a package of legislative measures to stimulate the development of the domestic semiconductor industry. The House of Representatives voted to pass the bill, which includes $52 billion in subsidies. About $39 billion will go directly to building new semiconductor manufacturing facilities.

Ripping has no limits lately.

-

American chip maker Texas Instruments announced plans to invest $3.5 billion annually in the production of semiconductor chips in the United States until 2025 as part of the fight against the current deficit in electronic components. This is significantly more than the capital investments that the company has made in recent years.

Of course, current profits are staggering.

-

The European Union (EU) has published a set of provisions in the EU Chip Act, which is intended to be "Europe's blueprint for regaining world leadership in the semiconductor industry," according to PCGamer. Europe wants to join the semiconductor technology race and bring the results of its advanced research to production, as the IMEC research center is already engraving 1.4 nm wafers. By 2030, it is planned to invest 11 billion euros in the creation of a comprehensive platform for the industrial implementation of advanced technological processes through the joint efforts of the EU member states.

-

Samsung plans to increase the price of its chip manufacturing services by 15% to 20% in the second half of 2022. At the same time, the production of products based on mature technical processes will become more expensive. The company has already agreed with some of its clients, while negotiations are still ongoing with the rest, Bloomberg reports, citing sources close to the issue. Samsung itself declined to comment.

Nice, more inflation.

-

The CEO of GlobalFoundries, the world's fourth-largest contract chipmaker, is fond of repeating that by the end of the decade, the semiconductor market will double to a trillion US dollars. He is also convinced that in order to overcome the shortage of components, a comparable amount must be invested in their production.

Topical considerations Tom Caulfield (Tom Caulfield), according to Seeking Alpha, this week shared with the audience of the TV channel CNBC. The global expansion of semiconductor production, according to the head of GlobalFoundries, will continue without regard to possible macroeconomic difficulties such as the “bottlenecks” currently observed in the supply chains of components. All problems will be solved sooner or later, according to Caulfield, and chip production will continue to grow.

By 2024, the company will increase its own production capacity by 60% compared to 2020 levels. Already, GlobalFoundries has orders for two years in advance; it is not afraid of a possible decrease in demand in certain market segments. Firstly, demand is now falling in the segment of PCs and budget smartphones, and it is weakly dependent on them. Second, any modest gaps in demand in one direction can be offset by others, since global demand still exceeds supply by 20%.

-

U.S. Secretary of Commerce Gina Raimondo said on Wednesday that lawmakers appear to be moving to carve off $52 billion in semiconductor chips manufacturing subsidies from a larger bill on boosting U.S. competitiveness with China.

"Things seem to be coalescing around the path of chips, or maybe chips plus a thing or two, and getting it done this month," Raimondo told Reuters in a telephone interview. "It seems like that's what Congress is coalescing around."

A smaller bill could also include investment tax credits for semiconductor manufacturing, she said, but emphasized that discussions are very fluid. "That is a good outcome because the worst outcome is getting nothing done by Aug. 4," when Congress leaves for summer recess, she said. "Better to get chips plus a little done than nothing done."

Another round of free money to this guys.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,964

- Blog5,723

- General and News1,342

- Hacks and Patches1,151

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm99

- ↳ Compacts and Camcorders299

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras121

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319