It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Renesas Electronics Corp., one of the biggest makers of automotive chips, said a fire halted production at one of its Japanese plants. The incident may exacerbate a shortage of semiconductors that has already curbed vehicle output across the industry.

The company said it’s still trying to ascertain the amount of damage in the clean room of its N3 building in Hitachinaka, Ibaraki Prefecture. There were no casualties. Clean rooms are designed to keep impurities from contaminating semiconductors, so fire damage has the potential to severely disable production.

“While there was no damage to the building, we confirmed damages to some of the utility equipment,” the company said in a statement. “We have been unable to confirm the safety of the clean room, which is the site of the fire, we have been unable to enter the clean room and determine the cause of the fire.”

One thing after another.

-

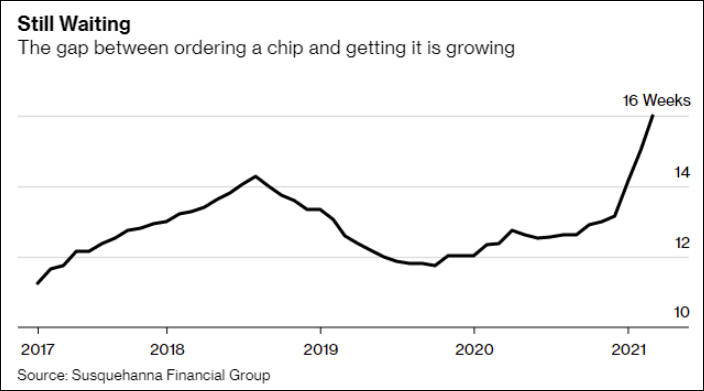

Supply in the semiconductor market has been so tight that prices in many segments, including foundry services, have been rising. Taiwan's pure-play foundry houses are now in contract talks with clients for 2022, and they are looking to introduce floating price schemes to make sure their pricing will reflect the volatility in costs, supply and demand.

More inflation and fuzzy future.

-

$20 billions from new US stimulus will be given to Intel to make factories

Intel has announced plans to invest about US$20 billion to build two new fabs in Arizona in line with what it calls its IDM 2.0 strategy, seeking to become a major provider of foundry capacity in the US and Europe to serve worldwide customers.

"We are setting a course for a new era of innovation and product leadership at Intel," said Intel CEO Pat Gelsinger in a webcast where he announced the company's IDM 2.0 manufacturing expansion plans.

"Intel is the only company with the depth and breadth of software, silicon and platforms, packaging, and process with at-scale manufacturing customers can depend on for their next-generation innovations. IDM 2.0 is an elegant strategy that only Intel can deliver - and it's a winning formula. We will use it to design the best products and manufacture them in the best way possible for every category we compete in."

To accelerate the IDM 2.0 strategy, Gelsinger said two new fabs will be built in Arizona at at the company's Ocotillo campus. These fabs will support the increasing requirements of Intel's current products and customers, as well as provide committed capacity for foundry customers, he said.

This build-out represents an estimated investment of about US$20 billion, which is expected to create over 3,000 permanent high-tech, high-wage jobs, over 3,000 construction jobs, and approximately 15,000 local long-term jobs, said Gelsinger.

"We are excited to be partnering with the state of Arizona and the Biden administration on incentives that spur this type of domestic investment," he added.

Intel expects to accelerate capital investments beyond Arizona, and Gelsinger said he plans to announce the next phase of capacity expansions in the US, Europe and other global locations within the year.

Gelsinger reaffirmed the company's expectation to continue manufacturing the majority of its products internally. The company's 7nm development is progressing well, driven by increased use of extreme ultraviolet lithography (EUV) in a rearchitected, simplified process flow. Intel expects to tape in the compute tile for its first 7nm client CPU (code-named Meteor Lake) in the second quarter of this year.

-

TSMC will move N4 (namely 4nm process) to volume production in the fourth quarter of 2021, ahead of the 2022 timeframe set previously, according to sources at fab toolmakers.

It is very good for TSMC marketing team as rebranding 5nm into 4nm (by adding small improvements) will pour billions into PR and advertising machines.

-

The current short supply of semiconductor fab capacity is not normal, as the overall capacity should be more than enough to satisfy all demand in normal times, according TSMC chairman Mark Liu, who describes as "economically unrealistic" attempts by the US and Europe to expand their own fab capacity to satisfy all of their needs.

Interesting, as this guy practically eats billions of US and EU money each month.

-

According to employees at Intel's Hillsborough, Oregon plant, the company intends to rename (to make them look better!) its manufacturing processes. Announcement of this came from Ann Kelleher, head of Intel's technology development department. In the opinion of the company's management, the current numbering does not reflect the leading technological position of Intel in the production of chips, and this point needs to be clarified.

Historically, at the stage of transition from 90- to 32-nm technological processes, the definition of technological standards of production for each company has become special. There is a universal metric that could reveal the details of the technical process - this is the minimum step of the line projected onto the crystal. However, this approach cannot effectively advertise products. Therefore, the geometry of the transistors, the step of their arrangement on the crystal, the number of transistors in the cache memory cell, and much more were used.

To date, the marketing of Samsung and TSMC has clearly suppressed Intel's marketing. The first and the second are already getting ready to release "3nm chips" next year, and Intel will start producing "7nm processors" only a year or two after that.

The battle of marketers while the real progress sucks.

-

Chip shortages may start easing as early as the first half of 2022, according to CK Tseng, president for Arm Taiwan.

Tight capacity at foundries has led to shortages of many chips, which is unlikely to be relieved until at least the first half of next year, said Tseng at a press conference in Taipei on March 31.

Every capitalist want to gain something even during war. Same here. Industry pulled all stops, started making fake shortages, promote them to media, causing real new orders rush and covering first lies with them.

-

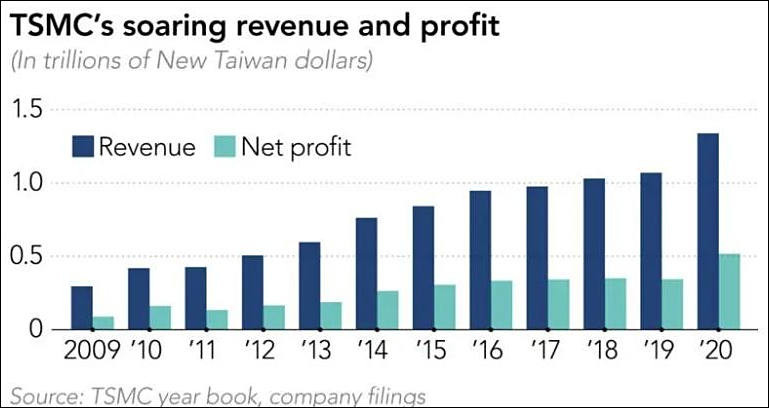

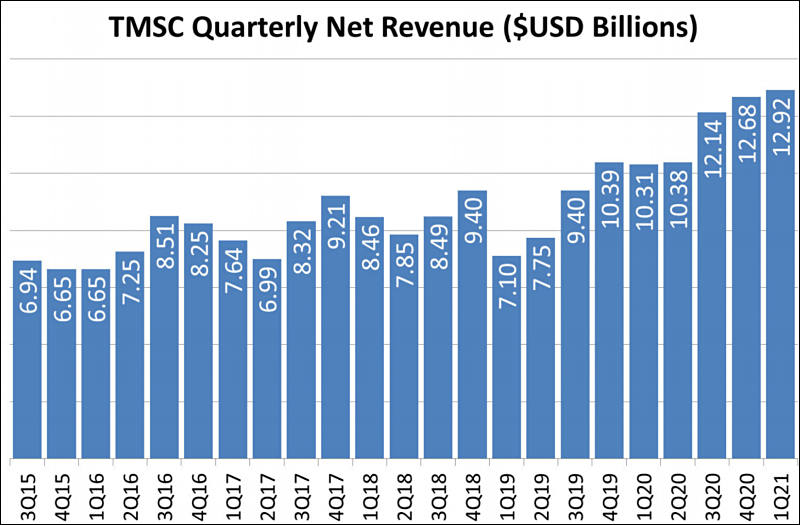

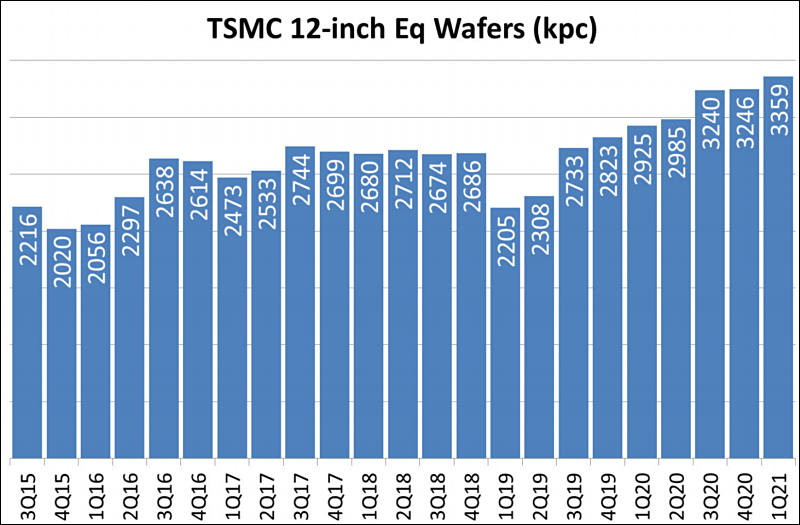

TSMC's consolidated revenue for March and first-quarter 2021 both set record highs.

TSMC reported revenue for March 2021 climbed 21.2% sequentially and 13.7% on year to NT$129.13 billion (US$4.54 billion).

TSMC's revenue for March 2021 outpaced the previous record high set in September 2020.

Criminals.

-

In its first budget proposal to Congress on Friday, the White House called for new funding to fight the ongoing semiconductor shortage.

Among other measures, the White House’s budget request includes $150 million to fund two new manufacturing programs, including one targeting domestic semiconductor manufacturing

The “American Jobs Plan,” the sweeping $2 trillion infrastructure package unveiled in March, also included new funding to build domestic chip manufacturing capacity, allocating over $50 billion for investment in the sector

They need money and lot of them, for free.

-

Industry sources of shortages

Industry source told that semiconductor shortages have nothing to do with market conditions but is mainly disinformation made to hide big inflation in the sector. Talking about shortages allow to shift the blame.

-

Worldwide sales of semiconductor manufacturing equipment surged 19% from US$59.8 billion in 2019 to a new all-time high of US$71.2 billion in 2020, according to SEMI.

China claimed the largest market for new semiconductor equipment with sales growth of 39% to US$18.72 billion.

Sales in Taiwan, the second-largest equipment market, remained flat in 2020 with sales of US$17.15 billion after showing strong growth in 2019, SEMI said. Korea registered 61% growth to US$16.08 billion to sit in third.

Annual spending also increased 21% in Japan and 16% in Europe as both regions are recovering from the contraction in 2019, SEMI continued. Receipts in North America decreased 20% in 2020 following three years of consecutive growth.

Bad things coming, as up to 60% of money spent came for free from governments.

-

A power outage experienced by TSMC's Fab-14A P7 at the Southern Taiwan Science Park (STSP) on April 14 prompted the foundry to halt part of its 40/45nm and other mature-node chip production, according to market sources.

It is just accident. Of course.

-

US companies held a 50% share of total IDM sales and a 64% share of fabless sales worldwide in 2020, capturing 55% of total IC sales worldwide last year, according to IC Insights.

South Korea-based companies held 21% of total IC sales in 2020, said IC Insights. Taiwan-based companies held 7% of the global IC market, one point greater than the Europe- and Japan-based companies, while China-based companies held only 5% of total IC sales in 2020.

Semiconductor manufacturing and sales are one of the most profitable businesses, sometimes beating drugs.

For example average Nvidia GPU now have total profits (both to manufacturers and intermediates) comparable to heavy drugs.

-

TSMC has adjusted upward its quotes for mature processes, prompting suppliers particularly LCD driver IC firms to also raise their chip prices, according to industry sources.

All prices are rising fast.

-

TSMC's 3nm process technology will be another full node stride from its 5nm process, with risk production scheduled for later this year followed by volume production in the second half of 2022, Wei disclosed. "Our N3 technology development is on track with good progress," Wei added.

It is time for marketing wars and cheating.

-

Intel executives said it will spend $ 20 billion on two new US factories and will determine the location of the new facility in Europe in the next twelve months. The most likely candidate remains Ireland, where Intel has already had manufacturing facilities since 1989. Last quarter, the company promised that it would launch 7nm products in Ireland and more than double Intel's production in Europe. Ireland is home to half of Intel's European workforce.

It will be interesting how soon Intel will cease EU operations after increased tensions.

-

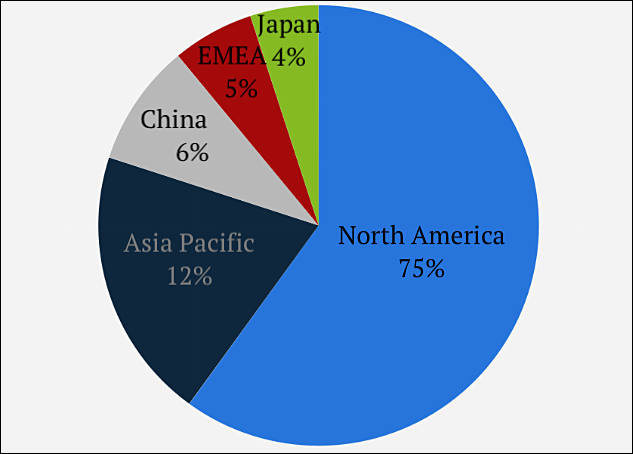

TSMC revenue by country

New data comes about TSMC founder and current top management. All of them had tight ties with CIA and backed by few other US based think tanks. Up to 70% of funds during initial years and during high concurrency periods came from US using shady channels (can originate by US backed drugs trade).

sa17056.jpg633 x 454 - 29K

sa17056.jpg633 x 454 - 29K -

United Microelectronics (UMC) expects to see its gross margin climb to 30% in the second quarter from 26.5% in the first, with its wafer bit shipments and ASPs to register sequential increases of 2% and 3-4%, respectively.

Note that for now idea is to somehow get around the wall by rising all prices fast.

In camera world we had same idea starting being implemented in 2012.

It will lead to same staggering disaster.

-

Taiwan's President Tsai Ing-Wen called on the country to save water as the island nation faced its worst drought in 60 years. Tsai noted that the drought hit Taichung City, where TSMC's manufacturing center is located, as well as factories that produce LCD displays. Both industries consume huge volumes of water, and therefore, they have hard time now.

The drought could exacerbate the global chip shortage, which forces TSMC to operate at full capacity. Lack of water for technical needs may force the company to reduce production. The water level at two large dams in the Taichung area dropped to about 5%. Taiwan's Ministry of Economy demanded that companies cut water consumption by 15 percent on April 6.

Now water levels will be blamed for industry issues.

-

According to the head of Intel Corporation Pat Gelsinger, the industry will not be able to cope with the problem of shortage of semiconductor products for several years.

They need money.. lot of them..

-

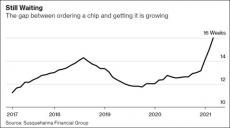

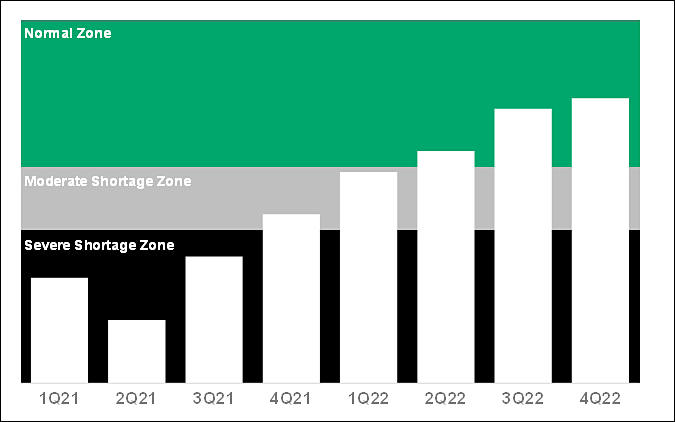

It will be some time until thing will back to "normal", this means around 2-3x of current prices.

sa17244.jpg675 x 422 - 28K

sa17244.jpg675 x 422 - 28K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,964

- Blog5,723

- General and News1,342

- Hacks and Patches1,151

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm99

- ↳ Compacts and Camcorders299

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras121

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319