-

Japan’s Fujifilm Holdings is set to take over Xerox Corp in a $6.1 billion deal, combining the U.S. company into their existing joint venture to gain scale and cut costs amid declining demand for office printing.

The acquisition announced on Wednesday comes as Xerox has been under pressure to find new sources of growth as it struggles to reinvent its legacy business amid waning demand for office printing. Fujifilm is also trying to streamline its copier business with a larger focus on document solutions services.

Consolidation of R&D, procurement and other operations would enable Fuji Xerox to deliver at least $1.7 billion in total cost savings by 2022, the two companies said.

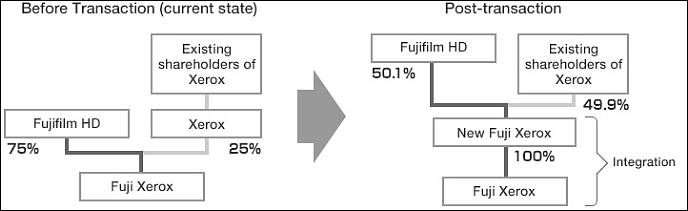

Fujifilm now owns 75 percent of Fuji Xerox, the joint venture going back more than 50 years ago which sells photocopying products and services in the Asia-Pacific region.

The companies will close some Fuji Xerox factories and cut north of 10,000 jobs by 2020, largely in the Asia Pacific region.

The combined company will keep the Fuji Xerox name and become a subsidiary of Fujifilm, with dual headquarters in the United States and Japan, and listed in New York. It will be led by Xerox CEO Jeff Jacobson, while Fujifilm CEO Shigetaka Komori will serve as chairman.

-

Bad. More monopolies.

-

Xerox Corp (XRX.N) has scrapped a planned $6.1 billion deal with Fujifilm Holdings Corp (4901.T) in a settlement with activist investors Carl Icahn and Darwin Deason that also hands control of the U.S. photocopier giant to new management.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319