It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

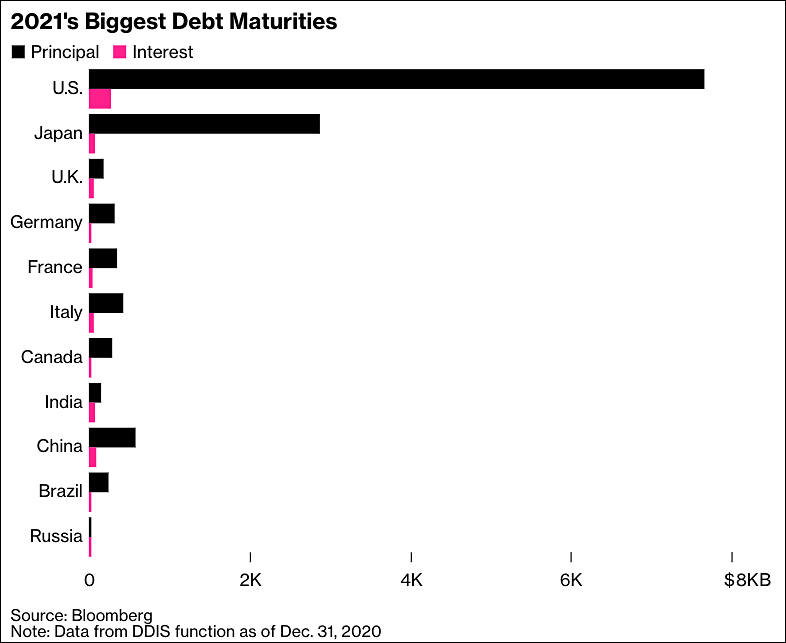

The amount due in the next 12 months is $7340 billions, or approximately 25.8 normalized monthly US budget revenues.

Of these, $3995 billions will mature in the next 3 months - the normalized US budget income in 14 months.

It present FED road looks like very thin hair, any error in balancing on it - and it'll be huge deflation and economic collapse or huge inflation and... economic collapse.

-

USA has a printing press. As long as the debt is marked in USD, it will simply be rolled over. You cannot have a debt problem as the nations debt is in the local currency.

-

You cannot have a debt problem as the nations debt is in the local currency.

It is not purely technically debt problem - it is trust problem.

Any small error now - and system will become unstable and with each new day they need more intense bubbles to store imbalances.

Main issue is that it is tiny amount of people who are becoming "richer", they are more and more distant from all other society. And it is harder for system to contain newly made virtual dollars.

-

A sophisticated hacking group backed by a foreign government stole information from the U.S. Treasury Department and a U.S. agency responsible for deciding policy around the internet and telecommunications, according to people familiar with the matter.

Seems like we are close.

-

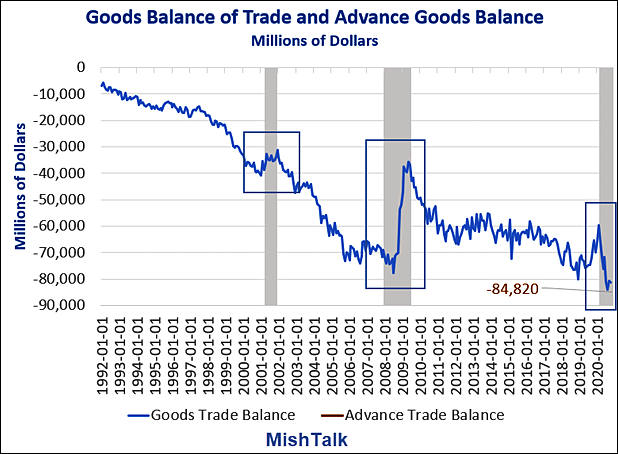

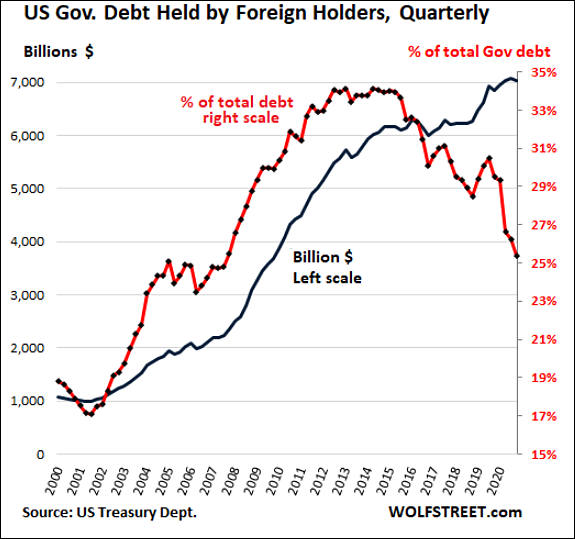

Trade balance don't help at all as US is using new debt to cover it

sa16047.jpg618 x 454 - 67K

sa16047.jpg618 x 454 - 67K -

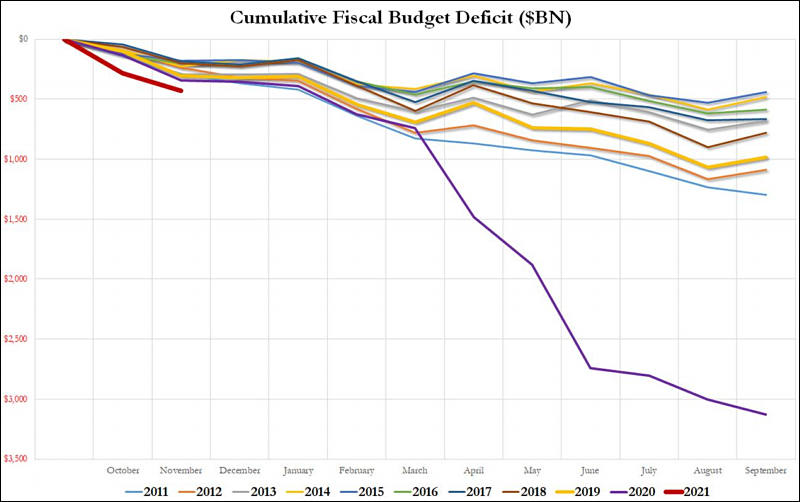

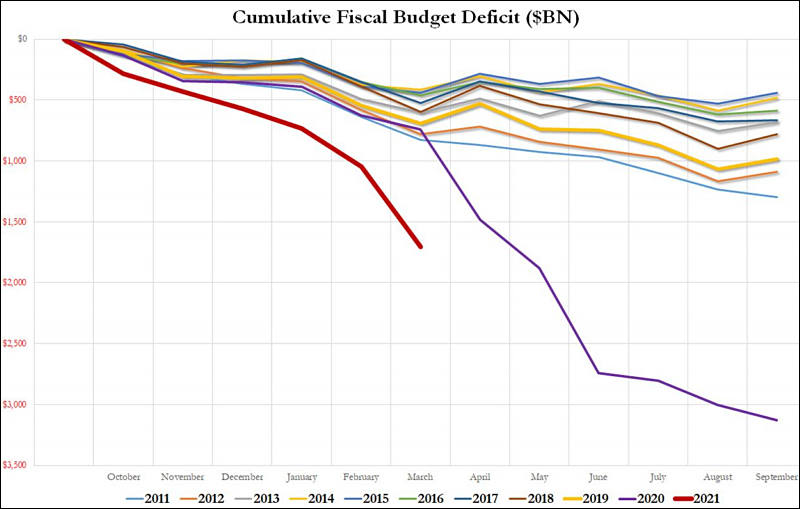

The deficit of the US state budget in December increased by 10.8 times in annual terms and amounted to a record $143.562 billion for this month, the country's finance ministry said. In December 2019, the figure was $13.286 billion.

Budget revenues increased last month by 3.1% - to $346.119 billion compared to $ 335.805 billion a year earlier. Meanwhile, spending jumped 40.3% to $489.682 billion from $ 349.091 billion in December 2019. This is mainly due to the measures of the government of the country to keep the economy afloat amid the COVID-19 pandemic, as well as the costs of developing a vaccine against coronavirus infection.

-

“This policy with China matters … to every one of the people who is out there seeking employment,” Pompeo advised. “If we get this wrong, Maria, we will live in a world that is so deeply different. We will see these sanctions on our leaders pale in comparison to the pain and the absence of prosperity that will be here in the United States of America if we don’t get this right. It’s one of the things that I’m proudest of that we did. We protected American jobs. We protected American businesses. We made sure that our intellectual property was in a better place. These are the things that will ultimately matter.”

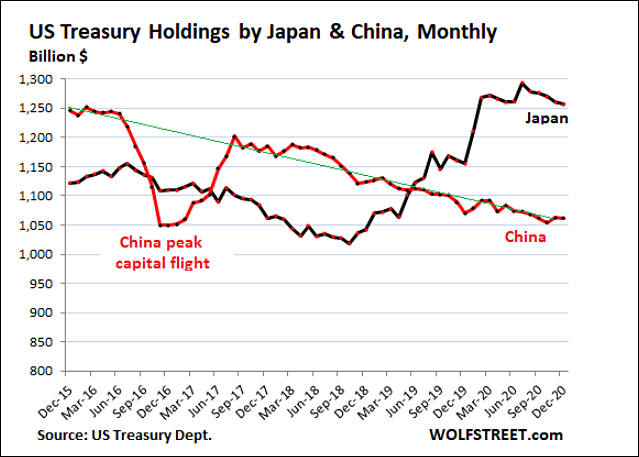

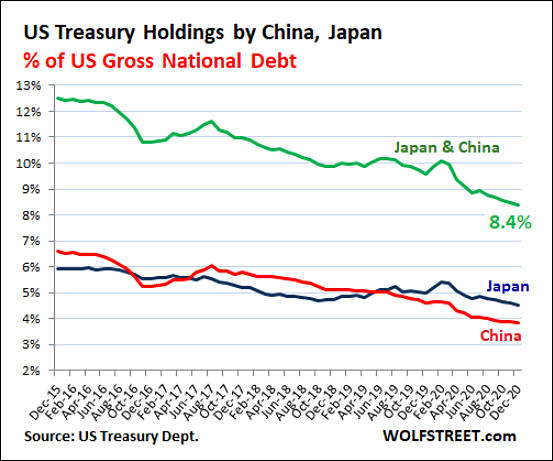

If China suddenly will demand some real goods in exchange for theirs... Yes, it will be certainly lack of prosperity.

-

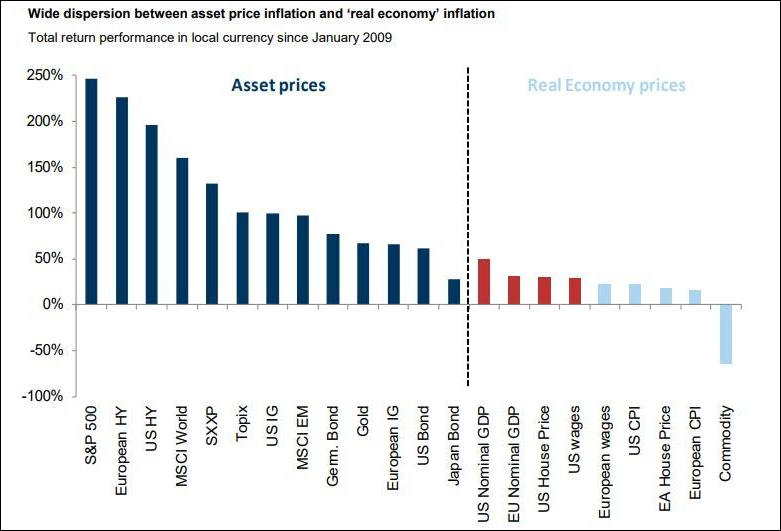

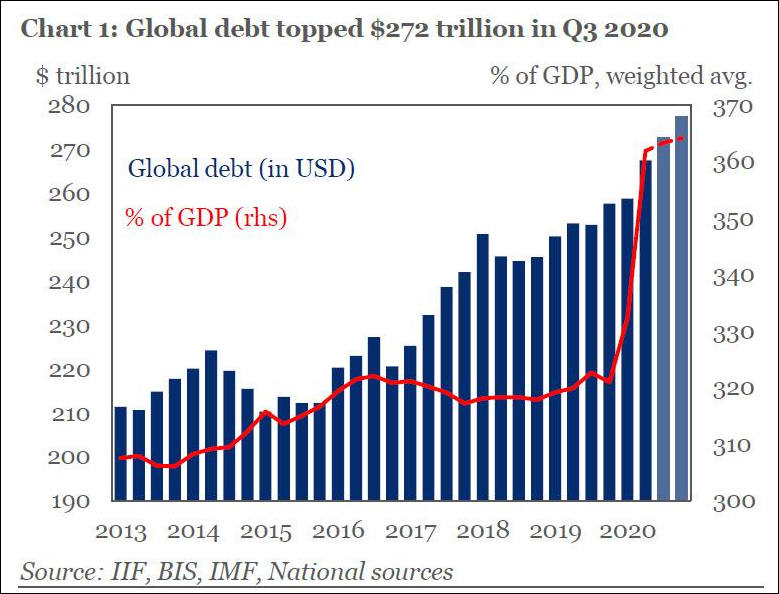

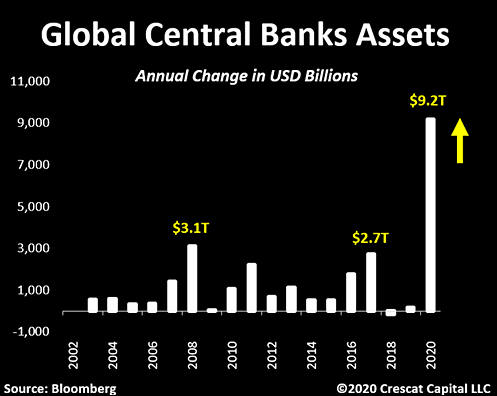

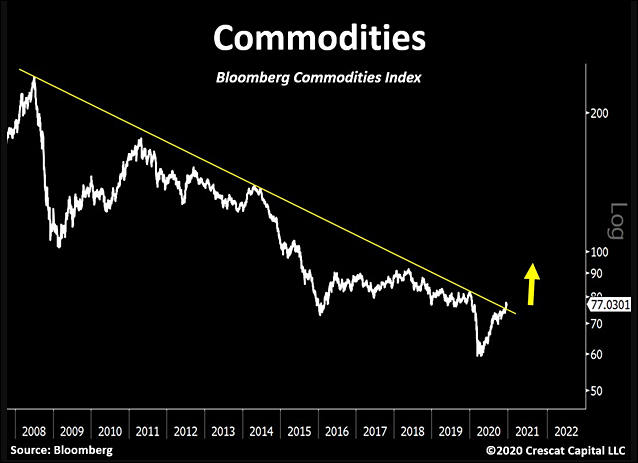

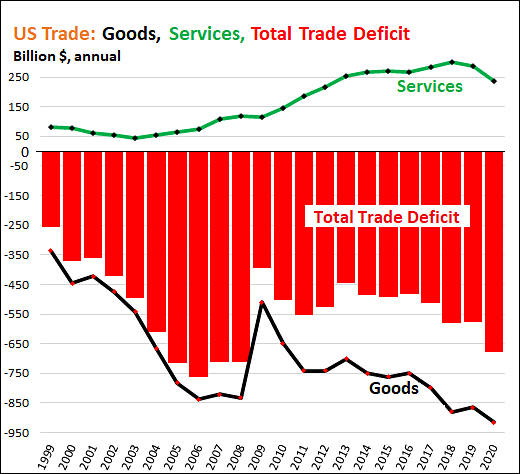

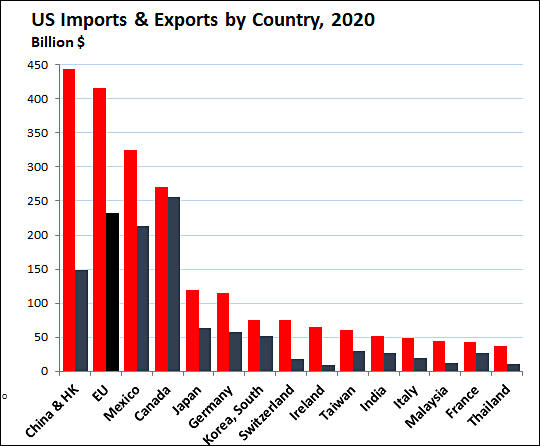

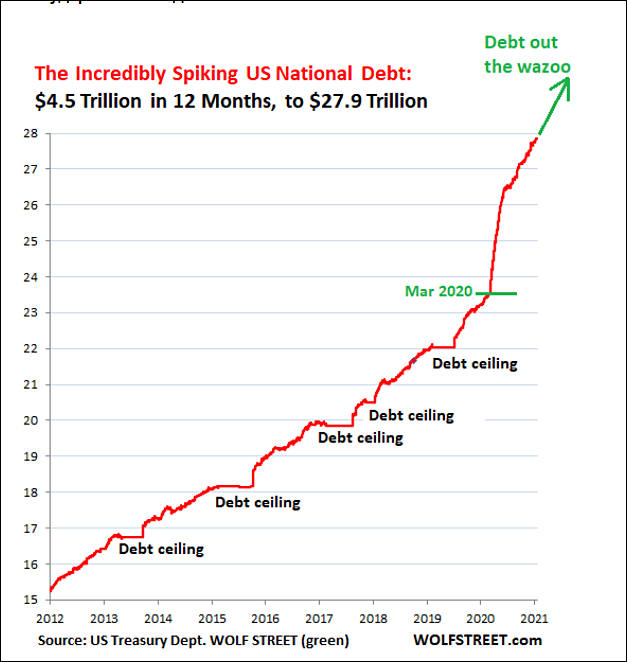

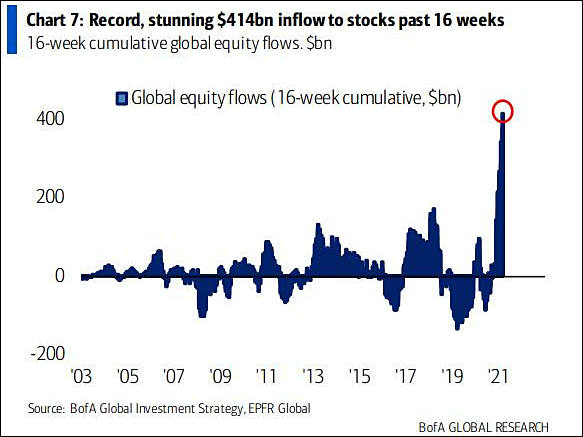

New records in exchange of debt to real goods

sa16416.jpg520 x 474 - 61K

sa16416.jpg520 x 474 - 61K

sa16417.jpg540 x 446 - 47K

sa16417.jpg540 x 446 - 47K -

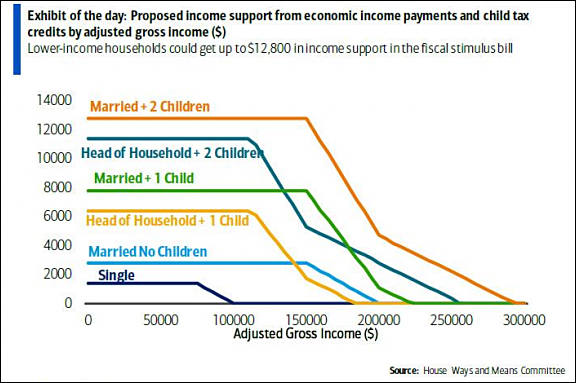

Considering that US reached new records where for each collected dollar that print now another fake one..

sa16434.jpg576 x 383 - 46K

sa16434.jpg576 x 383 - 46K -

This is how exchange of newly printed money to real goods look like near US port :-)

And it will continue, for a little while. But you really do not want to know that happens next.

-

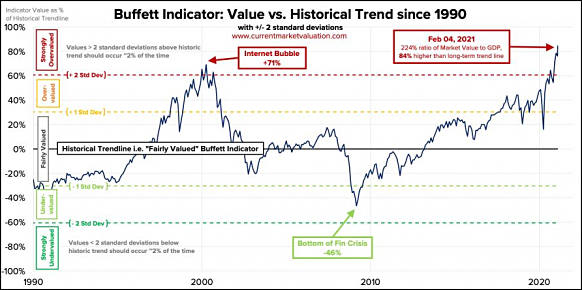

In order to simply touch run-of-the-mill historical valuation norms, the S&P 500 would have to lose somewhere in the range of 65-70% over the completion of this cycle.

-

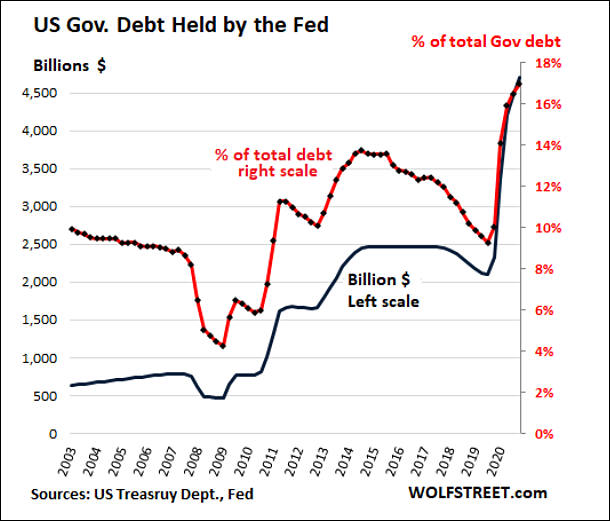

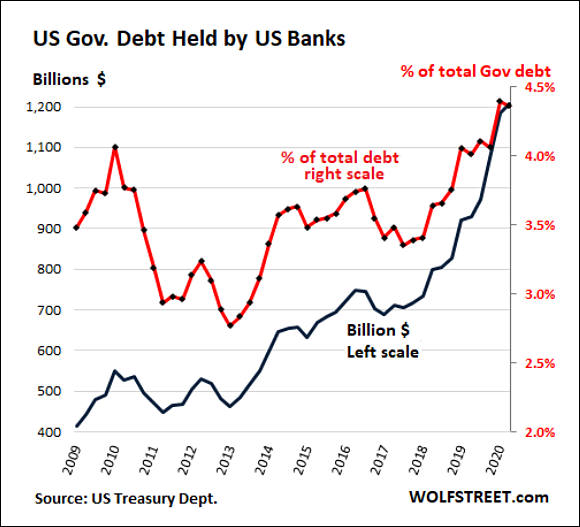

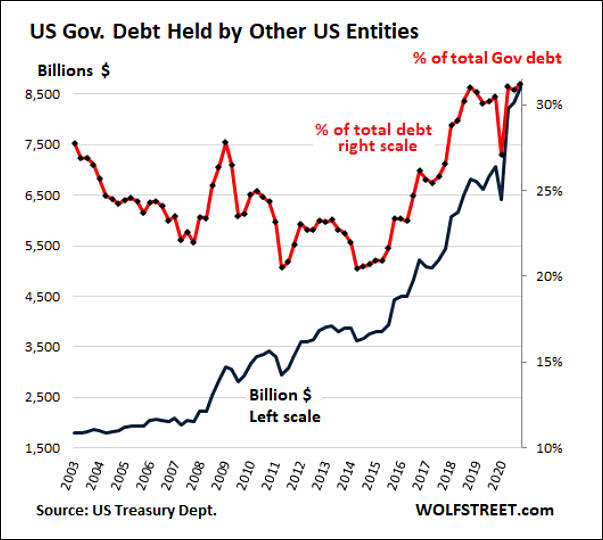

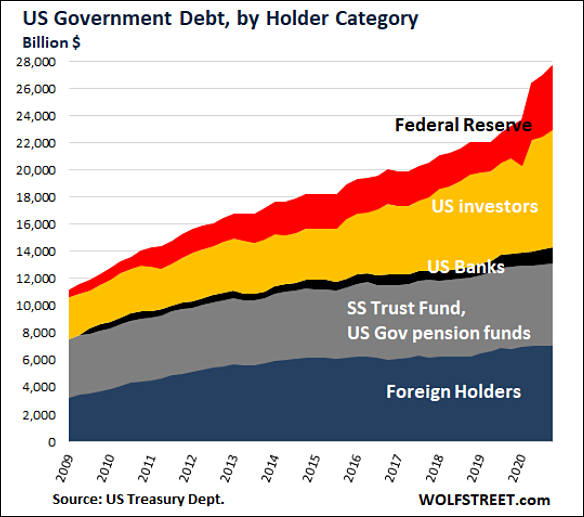

Lot US based banks and companies won't make it past this exponential bubble

sa16508.jpg627 x 662 - 62K

sa16508.jpg627 x 662 - 62K

sa16509.jpg575 x 539 - 56K

sa16509.jpg575 x 539 - 56K

sa16510.jpg639 x 457 - 53K

sa16510.jpg639 x 457 - 53K

sa16511.jpg553 x 461 - 51K

sa16511.jpg553 x 461 - 51K

sa16512.jpg610 x 521 - 53K

sa16512.jpg610 x 521 - 53K

sa16513.jpg580 x 527 - 51K

sa16513.jpg580 x 527 - 51K

sa16514.jpg603 x 540 - 54K

sa16514.jpg603 x 540 - 54K

sa16515.jpg584 x 517 - 52K

sa16515.jpg584 x 517 - 52K -

The American economy should not fear hyperinflation amid the recovery. The expected high volumes of spending after the pandemic, which the Americans have saved, will not be able to significantly raise prices up and lead to hyperinflation due to the fact that the Fed has been pursuing a policy to reduce inflation for many years "I don't think these effects have to be significant or persistent, and the real reason for this is that we have had decades of well-contained inflation expectations.

Big warning.

-

Injections to keep stock market the only shining star are staggering.

sa16613.jpg583 x 437 - 39K

sa16613.jpg583 x 437 - 39K -

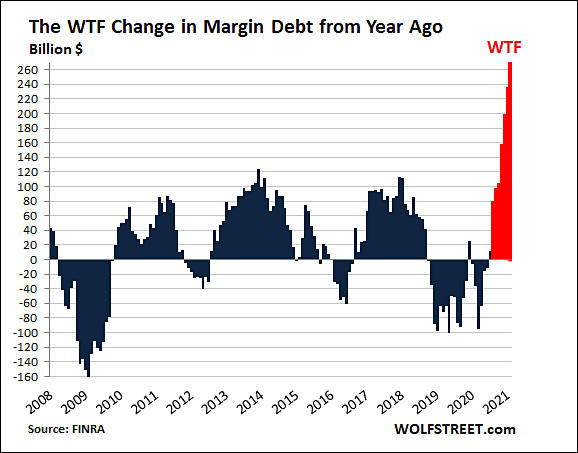

Margin debt – the amount that individuals and institutions borrow against their stock holdings as tracked by FINRA at its member brokerage firms – is just one indication of stock market leverage. But FINRA reports it monthly. Other types of stock market leverage are not reported at all, or are disclosed only piecemeal in SEC filings by brokers and banks that lend to their clients against their portfolios, such as Securities-Based Loans (SBLs). No one knows how much total stock market leverage there is. But margin debt shows the trend.

In February, margin debt jumped by another $15 billion to $813 billion, according to FINRA. Over the past four months, margin debt has soared by $154 billion, a historic surge to historic highs. Compared to February last year, margin debt has skyrocketed by $269 billion, or by nearly 50%, for another WTF sign that the zoo has gone nuts.

sa16744.jpg578 x 453 - 51K

sa16744.jpg578 x 453 - 51K -

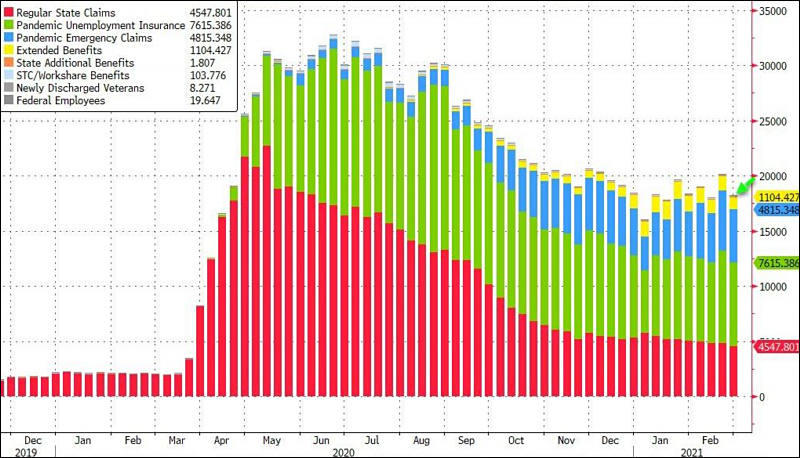

Total number of Americans filing for jobless benefits fell back to just ove 18 million this week... but it's still 18 million and hasn't improved materially for four months...

sa16757.jpg800 x 458 - 95K

sa16757.jpg800 x 458 - 95K -

Over the past year, as fiscal and monetary stimulus flooded the economy with cash, US stocks are up more than 75%. According to Wilshire, as of March 23, 95.9% of the more than 3,000 stocks included in the Wilshire 5000 total market index had an overall positive growth of 12 months. No other one-year period has come close to this since the end of February 2004, when 93% of shares had a similar 12-month rise.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,976

- Blog5,724

- General and News1,351

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319