It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Taiwan as part of criminal plot

Revenue from the export of integrated circuits and semiconductor stuff in June reached a record high. China and the United States remained the most loaded export destinations, demonstrating an increase in profile revenues by 37.8 and 34.5% compared to the previous year's level, respectively.

Total exports revenue of Taiwan across all industries in June grew by 35.1% year-on-year to $ 36.7 billion, which is already the second highest value on record. Import revenue increased by 42.3% to $ 31.5 billion, the foreign trade balance increased to $ 5.2 billion compared to last year.

All we saw is planned crime that involved mass media and top leading corporations and banks.

-

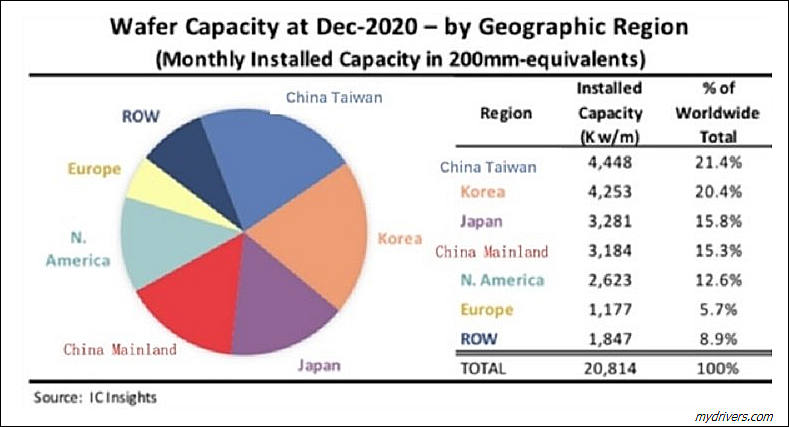

Intel is currently considering Germany, the Netherlands, France, Italy and Belgium as possible sites for the construction of a new enterprise. The main requirement, in addition to the availability of a free plot of land with an area of 405 hectares, is the availability of the necessary engineering infrastructure and access to qualified labor. Starting with two factories, Intel could eventually expand to eight, with an initial budget of $20 billion over the next decade could grow to $100 billion.

Intel is now trying to figure out exactly what local customers are interested in. The management of the processor giant believes that it will be difficult for Europeans to compete with Asian manufacturers without government subsidies, but the costs can be borne together, dividing them not only between large companies, but also between states. By joint efforts, it is possible to carry out not only development and research, but also the manufacture of the final product. Silicon wafers can be processed in one country and become ready-to-use chips in another. Now this is happening, it is just that the indicated links of the technological chain are better placed in Europe, according to Intel representatives.

It is now same for all of them, as they try to steal lot of taxpayers money.

-

TSMC is gearing up for a bigger presence in the automotive IC foundry market segment, with its newly-developed N5A process set to be available in the third quarter of 2022, according to industry sources.

TSMS PR expenses are now highest ever, and soon you will be watching how for hundreds of millions of marketing TSMC will be selling you old 7nm as newest 4nm process.

-

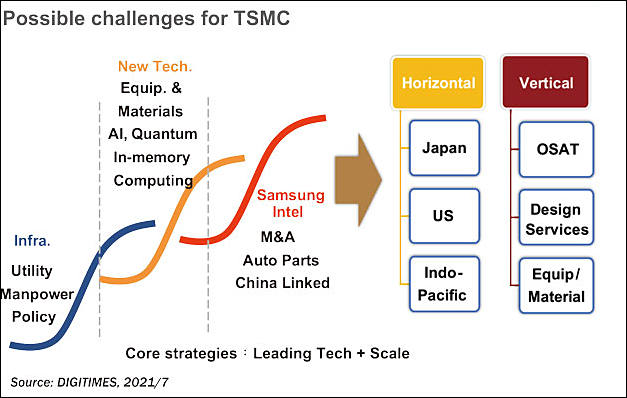

Biggest challenge for TSMC is understanding its true role.

As it is designed to be biggest lure for China to try to force Chinese elites it to escalate Taiwan conflict.

This is why US directly poured tens of billions of dollars for very long time into company, and this is why they ordered their largest corporations to move production to TSMC, even at the times where it was doubtful thing to do.

sa17685.jpg627 x 398 - 47K

sa17685.jpg627 x 398 - 47K -

Globalfoundries (GF) has announced expansion plans for its most advanced manufacturing facility in upstate New York over the coming years. These plans include immediate investments to address the global chip shortage at its existing Fab 8 facility as well as construction of a new fab on the same campus that will double the site's capacity.

GF said it will invest US$1 billion to immediately add an additional 150,000 wafers per year within its existing fab to help address the global chip shortage.

Big price hikes had been required for this.

Company also is getting ready for merger with Intel.

-

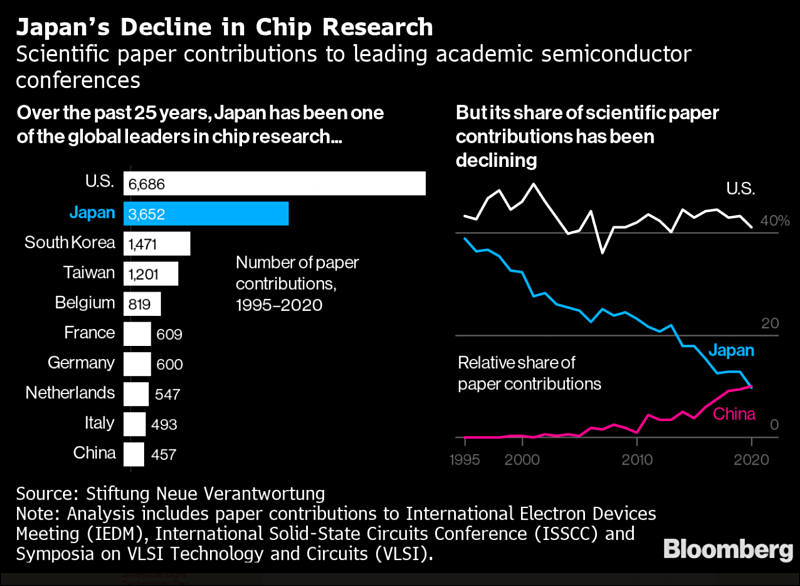

The planned TSMC fab in Kumamoto, on the island of Kyushu in western Japan, would go forward in two phases, according to Nikkei Asia. The board of TSMC is expected to decide on the investment in the current quarter.

The plant is expected to start operation in 2023. Once both phases are complete, the new fab will produce about 40,000 wafers per month in 28nm process. The fab is expected to be mainly used to make image sensors for Sony, TSMC's largest Japanese customer. Nikkei has been told that TSMC is open to a collaboration that would give Sony more say in operating the plant and negotiating with the Japanese government.

sa17777.jpg800 x 586 - 76K

sa17777.jpg800 x 586 - 76K -

United Microelectronics (UMC) plans to raise its foundry quotes for 40nm process technology by 10-15% starting the first quarter of 2022, as well as quotes for other mature process nodes by 5-10%, according to sources at IC design houses.

Inflation is picking up fast.

-

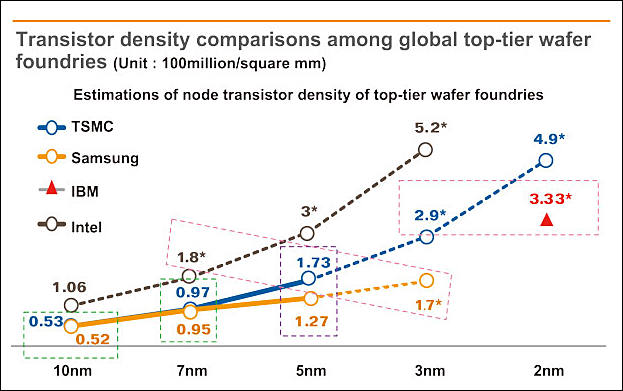

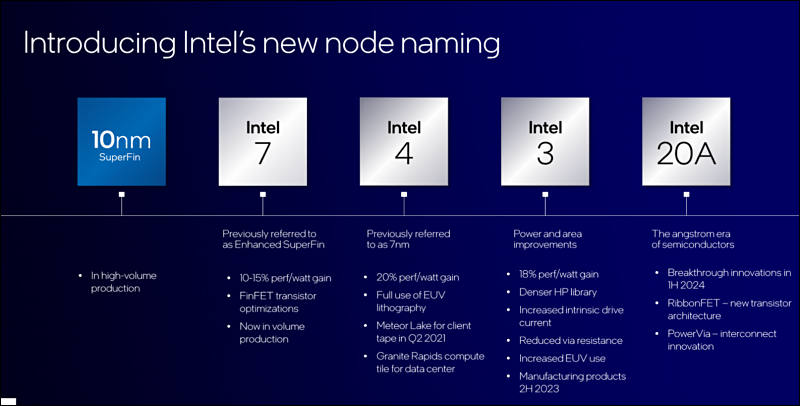

Intel officially declared that it is now marketing that reduces "nanometers"

Future Intel products (from 12th Gen Alder Lake) will no longer use the nanometer-based node nomenclature that both it and the rest of the chipmaking industry has used for years.

Intel is debuting a new naming scheme that it says will provide “a more accurate view of process nodes across the industry” and how Intel’s products fit into that landscape.

Third-generation 10nm chips will be referred to as “Intel 7,” instead of getting some 10nm-based name.

- Intel 7 (formerly Intel 10nm Enhanced SuperFIN technology) - will provide an increase in performance per watt of about 10-15% compared to Intel 10nm SuperFin by optimizing the structure of FinFET transistors. The technology will be used in the production of Alder Lake processors due this year and Sapphire Rapids server chips, which will begin shipping in the first quarter of 2022.

- Intel 4 (formerly Intel 7nm) - Will provide about 20% improvement in performance per watt along with further increases in transistor density and the introduction of EUV lithography. Intel 4 will debut in the second half of 2022 and will be used in Meteor Lake client processors and Granite Rapids server processors due in 2023.

- Intel 3 - Delivers about 18% performance per watt gain over Intel 4, leveraging further FinFET optimizations and enhanced EUV lithography. Intel 3 is expected to be ready for mass production in the second half of 2023.

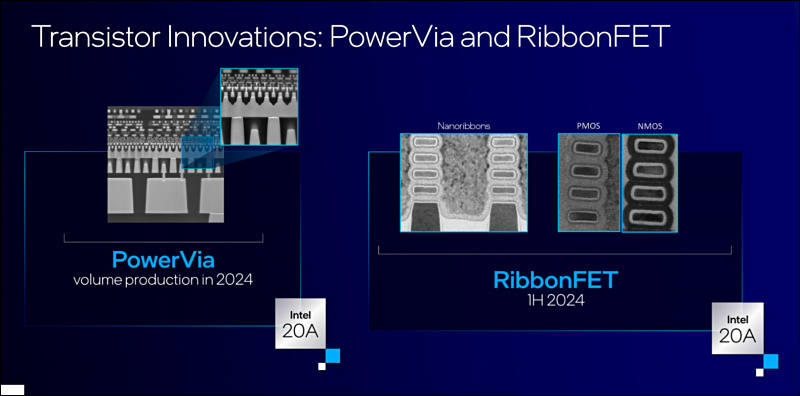

- Intel 20A - will be the first Intel process technology with the dimension of transistors in angstroms. The Intel 20A is expected to launch in 2024.

- Intel 18A - slated for early 2025. At this stage, Intel intends to implement High NA EUV lithography, for which the company is partnering with ASML.

sa17826.jpg800 x 406 - 43K

sa17826.jpg800 x 406 - 43K

sa17827.jpg800 x 396 - 42K

sa17827.jpg800 x 396 - 42K -

The Dutch company ASML reported its work in the second quarter of calendar 2021. The world's only manufacturer of advanced lithographic scanners for the production of chips sees a sharp and steady increase in demand for its products.

The speculations and total monopoly helped ASML increase its quarterly revenue and bottom line. Orders for lithographic equipment rose 75% quarter-on-quarter to 8.3 billion euros ($ 9.78 billion), and the company's net profit rose 38% to 1 billion euros ($ 1.17 billion).

ASML is now becoming biggest hurdle on he road of progress.

-

Having already raised its quotes for 28nm process technology, TSMC has moved to maintain the prices throughout the second half of this year, according to industry sources.

Criminals.

-

Intel CEO Pat Gelsinger spoke about the company's plans to build a new plant in the United States. As part of the IDM 2.0 program, the manufacturer plans to build an advanced factory that will process silicon wafers and assemble chips using the latest technologies.

We are considering building a plant in the USA. It will be a very large complex consisting of 6-8 production lines. The cost of each will be about $ 10-15 billion. This is a 10-year project with a budget of $ 100 billion. 10,000 people will participate in the construction. They will create jobs for 100 thousand people. In general, we want to create such a small town.

-

TSMC is on track to move its 3nm process technology to volume production in the second half of 2022 for Apple's devices, either iPhones or Mac computers, according to industry sources.

3nm is the last marketing step before long pause.

-

A new wave of prosperity is taking place in the global semiconductor industry. Fabless chipmakers, foundries and backend houses have all seen their supplies fall short of customer demand, which is expected to persist through 2022.

-

Apple has been TSMC's largest client, with its chip orders for the iPhone, iPad and Apple Watch continuing to account for more than 20% of the foundry's total wafer revenue, according to industry sources.

Interesting info.

-

IC shortage is disrupting production at many industry sectors amid tight foundry capacity. PC makers have disclosed that short supply of small ICs is expected to persist through 2022.

Capitalism is efficient! Make sure to remember this.

-

Samsung Electronics is unlikely to move its 3nm gate-all-around (GAA) FET technology to volume production until 2023.

In reality they have staggering issues with their present best process still.

-

Price hikes can do magic:

The worldwide semiconductor market is forecast to surge 25% in 2021, according to the World Semiconductor Trade Statistics (WSTS). WSTS estimated previously a 19.7% increase.

Following 6.8% growth in 2020, the worldwide semiconductor market is expected to grow 25.1% to US$551 billion in 2021.

-

Another hikes coming

United Microelectronics (UMC) has notified clients prices for its 28nm and 22nm process manufacturing will be adjusted upward in September, November and January 2022

-

TSMC has notified clients an about 10% price hike for its sub-16nm process manufacturing, with the new prices set to be effective starting 2022, according to sources at IC design houses.

-

TSMC is poised to raise its quotes including those for advanced sub-7nm process technologies, which will result in more manufacturing costs facing Apple and other major clients, according to industry sources.

Nicer.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,976

- Blog5,724

- General and News1,351

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319