It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

At the last quarterly reporting conference, the head of Intel, Robert Swan said that the company's specialists have managed to fix a defect that caused a delay in the development of 7-nm technology. By January, management should decide which of 2023 products Intel will produce and which will be outsourced.

“We will continue to invest in seven (nanometers). We will invest in five. We will invest in three, continuing to move forward, ”the head of the processor giant assured investors. He added that Intel will continue to be a vertically integrated manufacturer that independently produces products it develops.

Tragedy of 10nm still going on. But 7nm will join the party soon.

-

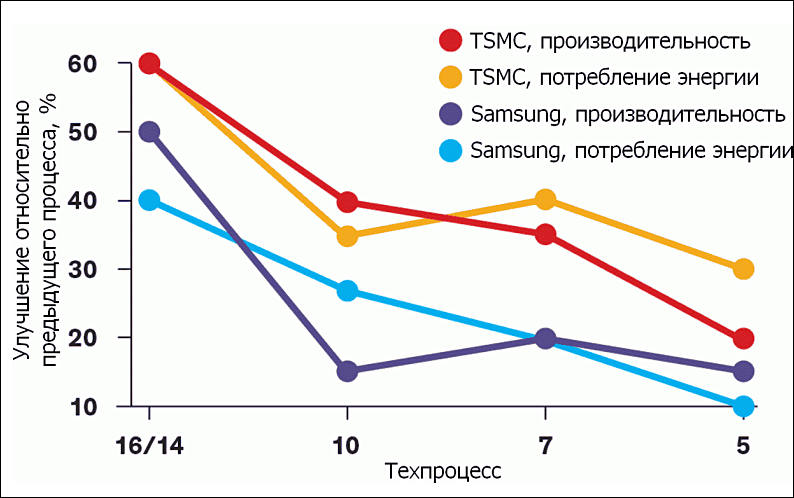

TSMC plans to launch an enhanced version of 3nm process technology in 2023, with Apple being the initial customer adopting the process, according to industry sources.

For Apple 3nm launch is very important, if it will fail or delays by 1-2 years it can be real dissaster.

As process advantage is 60-70% of all Apple performance gains for now.

-

The Nikkei Asian Review, citing UMC's customer service specialists, reported that there were no free quotas until the end of the second quarter of next year in most areas of activity, and for some, all orders were distributed until the very end of 2021. Even the desire of customers to pay more no longer allows UMC to timely fulfill all orders in full. It is reported that among the victims of the shortage of UMC customers there are large companies ordering the release of chips for working with Wi-Fi and Bluetooth - these are Intel, MediaTek and Realtek.

TSMC in this regard also cannot boast of matching the level of supply and demand. According to the source, TSMC's main component production quotas have been allocated until the third quarter of next year. Representatives of Kinpo Electronics note that the components ordered now will have to wait six, eight or even twelve months. Display maker AU Optronics said demand exceeds supply by 10% and the gap is widening.

This is result of extreme monopolization on market, especially this relates to equipment for making chips, as US now try to control all and everything and it slowed down production a lot.

-

Nvidia's new GeForce RTX 30 GPUs have been in tight supply due to unsatisfactory 8nm process yield rates at its foundry partner Samsung, according to industry sources.

Who could have though.

-

TSMC is expected to have an about 20% sequential increase in wafer shipments for 5nm process in first-half 2021, according to industry sources.

Almost all of this will go to non Apple orders.

-

Taiwan Semiconductor Manufacturing Company (TSMC) is ending its volume discounts. For its biggest customers, TSMC used to offer a discount - when you purchase 10s or 100s of thousands of 300 mm (12-inch) wafers per month, the company will give you a deal of a 3% price decrease per wafer, meaning that the customer is taking a higher margin off a product it sells. Many of the customers, like Apple, NVIDIA, and AMD, were a part of this deal.

Today TSMC is terminating this type of discount. Now, every customer will pay full price for the wafer, without any exceptions.

Need money.

-

Charlie Demerjian (author of SemiAccurate):

- 10nm in "full production" and "shipping for revenue" since late 2018. Charlie still doesn't think it's viable. Much more real than it once was though, but not good enough.

- Superfin is unquestionably far better than base 10nm. Better in just about every way. Yields are better, but still on the low side.

- CNL had a yield of <25% even with iGPU disabled (seems a bit high to me but huh).

- 10nm SF yields are far better but not as good as 14 (no surprises there). Past 50%.

- Not enough 10nm capacity to handle the entire product stack yet. Charlie doesn't like Rocket Lake, considers the backport "painfully stupid". Will be huge and a power hog.

- 14nm shortage caused by the fact that Intel had to bloat up die sizes.

- OEMs told they were to get a "small fraction" of orders of TGL. Improvements to yield won't fully help because no. of wafer starts is still low.

- He doesn't think 10nm will ever exceed 14nm capacity-wise.

- Ice Lake delayed again due to a bug, but this is a good thing. Looking like it'll come mid-late Q2 to early Q3 (although Charlie originally said March + 1.5-2 month delay?).

- Performance looks pretty poor. Akin to CL-SP actually - performance per socket remains the same but power rises. Core count for shipping parts dropped from 38 -> 36.

- Ice Lake is disappointing. Sapphire Rapids is way better. Comes in Q2 22.

- SPR was originally supposed to launch in Q2 21 to ship for Aurora but... yeah. Even then it was basically going to be a broken, alpha product which would be refined over multiple tapeouts.

- Once SPR fully rolls out and is fully sorted out it'll actually be pretty solid.

- The problem with SPR is timeline. ICL-SP was supposed to compete with Rome (and it would still lose even with the on-paper and significantly better specs than reality). Milan is going to likely beat SPR... over a year earlier and before ICL-SP rolls out. By the time SPR releases, Genoa will be here or right around the corner. Genoa was supposed to compete with GNR which is late 2023 now.

- If both companies iterate perfectly on their roadmaps as planned (much easier on AMD's side right now), Intel can not catch up to AMD until late 2024 or early 2025.

- AMD's biggest problem? Unsurprisingly - capacity.

- 7nm is significantly more delayed than the 6-12 months first claimed. PVC is in-hands basically now and it was the first 7nm product. Now it's on TSMC. Sometime December this year anyway.

- Intel may not know how much of a delay we're looking at with 7.

- Charlie thinks there are several problems with 7, not just 1. However, Charlie hasn't heard anything absolutely solid on the specifics here.

- Doesn't think Intel could sell fabs. Too many things problems involved. Fabs would need to be evaluated for the buyers needs etc etc.

- Foveros is more suited to low-power chips than servers/high power.

- Question about why ARM is more competitive in recent attempts vs previous attempts - Answer: more developed eco-system, lack of real glass-jaws compared to previous designs. Amazon is a bit more of a special case because they can design chips to exactly what they need with all the strengths and benefits that suit them best.

- Intel are going to out-source CPUs, but what and where is still being debated internally. Decision will be made in Q1 between SS and TSMC for different products. Nothing is set in stone yet.

- Intel are looking for a new CEO. There are multiple candidates, one has been shot down, 3 potential left. They are hoping to make the decision in Q1, probably after the Jan call. Does seem like Bob's going either way.

- Question: Will Intel do anything else with the backported core? A: I hope not.

- Intel won't outsource everything to TSMC because TSMC doesn't have the capacity. Intel grabbing capacity shouldn't take capacity away from AMD - TSMC should prioritise customers with long-term plans to stay with them.

- There is a 10nm desktop product coming (Alder Lake-S) but Charlie doubts there will be much capacity for it due to it being needed elsewhere.

-

On 3nm and Apple

Industry sources say Apple has already placed orders for the A and M series processors using the 3nm process technology. Sources did not say how many chips Apple ordered, but it did come to light that the vast majority of orders were for the M-series chipsets used in Apple computers. According to preliminary estimates, initially TSMC will produce up to 600 thousand 3-nm chips per year, and their mass production will start only in 2022. Considering that the first deliveries of such chips will be very limited, it can be assumed that the processors intended for the most expensive and productive Apple computers will be the first to be transferred to the 3-nm process technology.

It is also strong wish to move all production to US, at least for Apple.

Previously, TSMC announced that its 3nm process technology will provide a 10-15% increase in chip performance and a 20-25% increase in their energy efficiency.

And it looks like end of free performance gains.

-

China's SMIC, which has been added to a US trade blacklist, may have to put the development of its sub-14nm process technologies on hold.

-

The Nikkei Asian Review was able to find out details about the current state of the construction of TSMC plant in Arizona from the chairman of the board of directors Mark Liu. At least $ 12 billion will be spent on the construction of the enterprise, the construction of the buildings will begin next year, but TSMC has already formed a team of 300 specialists with experience in working with 5nm technology. They will oversee the construction of the plant in Arizona and monitor its technological armament. About 300 more young specialists with little experience in such industries will be sent to the south of Taiwan, where they will undergo a one-year “young fighter course” at the enterprise where 5nm products are already being produced. The training will be conducted in English to facilitate further adaptation of TSMC employees to work in the United States. The authorities of the latter of the countries are ready to provide the required number of work visas for future employees of the enterprise in Arizona, although TSMC, when recruiting staff in this situation, prefers candidates with an open visa.

-

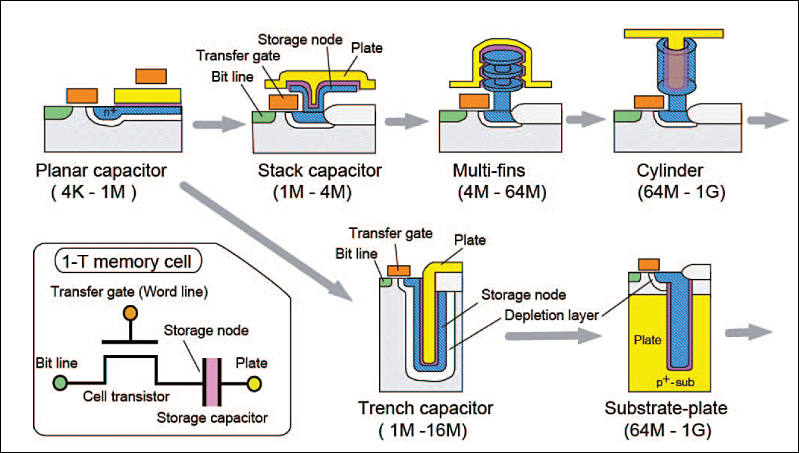

DRAM memory progress

You can see approach that is similar to that NAND manufacturers are doing, yet it is no layers for now.

sa16030.jpg799 x 453 - 72K

sa16030.jpg799 x 453 - 72K -

Intel has big issues

Third Point investment fund, which owns a $ 1 billion stake in Intel, sent a letter to chairman of the board of directors Omar Ishrak listing "strategic alternatives" designed to stop the company's business degradation.

Intel management is encouraged to augment the portion of products outsourced to third parties such as TSMC or Samsung. According to the authors of the initiative, it is advisable to create a joint venture with them to ensure the allocation of sufficient production capacity for the release of Intel products. These same joint ventures should attract new customers to the American soil for contract manufacturing of Intel - it is assumed that Apple or Microsoft will want to entrust a new contractor with the release of their processors in the United States.

Intel should get rid of some of its assets, according to activists. We are talking, in particular, about the business of Altera on the development of programmable matrices, for which Intel at one time dumped $ 16.7 billion. Investors also believe that Intel needs to do something about the outflow of qualified personnel, who are demoralized by the policy pursued in recent years company management. In general, Intel has already expressed its willingness to consider the Third Point proposals.

-

TSMC and Samsung Electronics have both encountered different but critical bottlenecks in the development of their respective 3nm process technologies, according to industry sources. The foundry houses may have to delay moving their respective 3nm process to volume production.

Who could have thought.

And it will be real tragedy for Apple.

-

Nice article on silicon progress and processes (use google translate)

sa16056.jpg794 x 498 - 60K

sa16056.jpg794 x 498 - 60K -

Issues are serious, free market ends here - EU Signs €145bn Declaration to Develop Next Gen Processors and 2nm Technology

In a major push to give Europe pride of place in the global semiconductor design and fabrication ecosystem, 17 EU member states this week signed a joint declaration to commit to work together in developing next generation, trusted low-power embedded processors and advanced process technologies down to 2nm. It will allocate up to €145bn funding for this European initiative over the next 2-3 years.

-

According to the source, the revenue of companies in the semiconductor sector in 2021 will increase by 8-10%, while the revenues of specialized companies will grow by 15-18%.

Everything becoming more and more expensive. Mergers will follow.

-

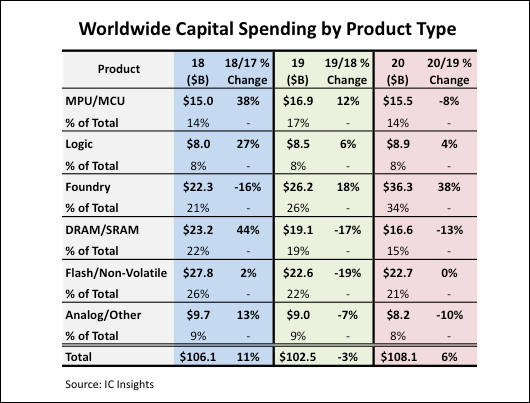

TSMC's 2021 capex will beat the record-high target of US$17 billion set last year, the report quoted market watchers as saying. The foundry will utilize its capex this year for the expansion of its 5nm process capacity, installation of more-advanced 3nm process capacity, and 2nm process R&D.

The pure-play foundry is expected to budget more than US$20 billion in capex this year.

Situation on TSMC is bad now as similar to Intel with super successful 14nm it can hit wall with problematic 3nm that they can't make to work still even for small batches.

-

The US trade ban against China-based SMIC has restricted the pure-play foundry's capability of obtaining semiconductor equipment for its process technology advancements. Nevertheless, a more significant challenge facing SMIC is insufficient supplies of chemical raw materials and consumables.

War will be vicious.

-

Taiwan manufacturers dreams

IC Insights has forecast that China-produced ICs will represent only 19.4% of the country's IC market in 2025, a fraction of the country's "Made in China 2025" goal of 70%.

Although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow. IC production in China represented 15.9% of its US$143.4 billion IC market in 2020, up from 10.2% in 2010, IC Insights said. Moreover, IC Insights forecast that this share will increase by 3.5pp from 2020 to 19.4% in 2025.

If China-based IC manufacturing rises to US$43.2 billion in 2025 as IC Insights forecasts, China-based IC production would still represent only 7.5% of the total forecast 2025 worldwide IC market of US$577.9 billion. Even after adding a significant markup to some of the Chinese producers' IC sales (many Chinese IC producers are foundries that sell their ICs to companies that re-sell these products to the electronic system producers), China-based IC production would still likely represent only about 10% of the global IC market in 2025.

Taiwan guys are very afraid of any Chinese progress as island is actually very bad place for silicone production due to constant quakes and very expensive also, where each firm keep huge profits.

Silicone factories building costs and workforce are much cheaper in all mainland Chinese regions. Hence the huge fears.

-

As automakers build vehicles that resemble more of a computer, they're facing a shortage of semiconductors that is now beginning to affect vehicle production. Both Ford Motor and Nissan Motor said they froze production at plants in the U.S and Japan, respectively, as they work with suppliers to resolve the situation and monitor additional impacts.

Rumors are that AMD, Nvidia and ASIC makers offered best terms trying to get their billions from crypto bubble.

-

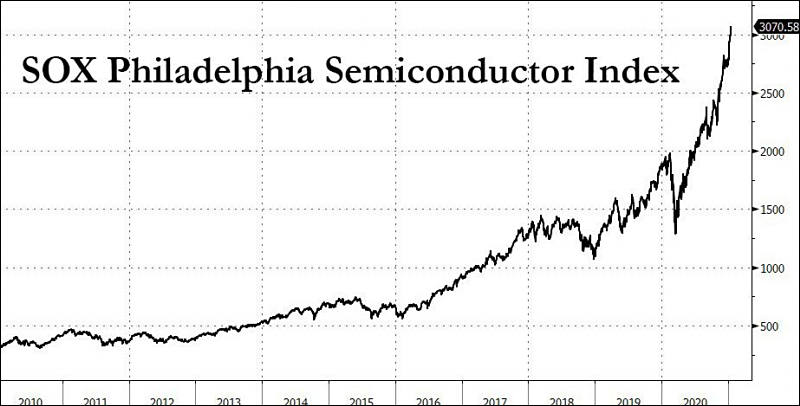

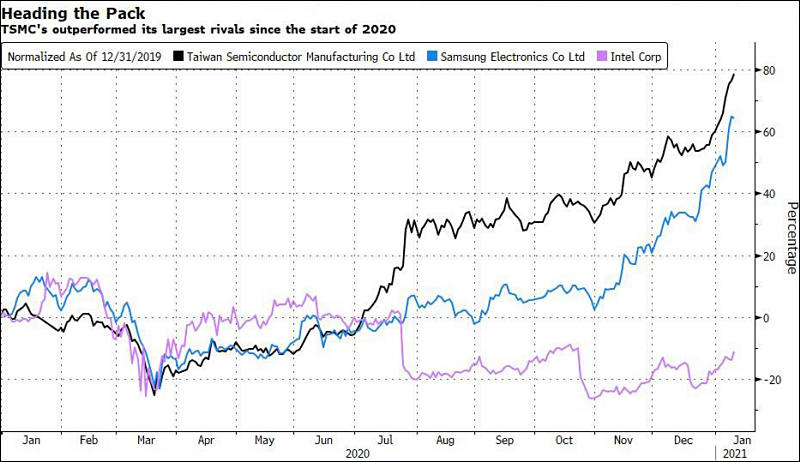

Media now help to make another stock bubble as TSMC badly needs money.

sa16220.jpg800 x 406 - 46K

sa16220.jpg800 x 406 - 46K

sa16221.jpg800 x 462 - 67K

sa16221.jpg800 x 462 - 67K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,976

- Blog5,724

- General and News1,351

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319