-

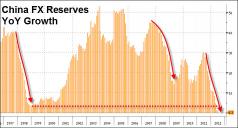

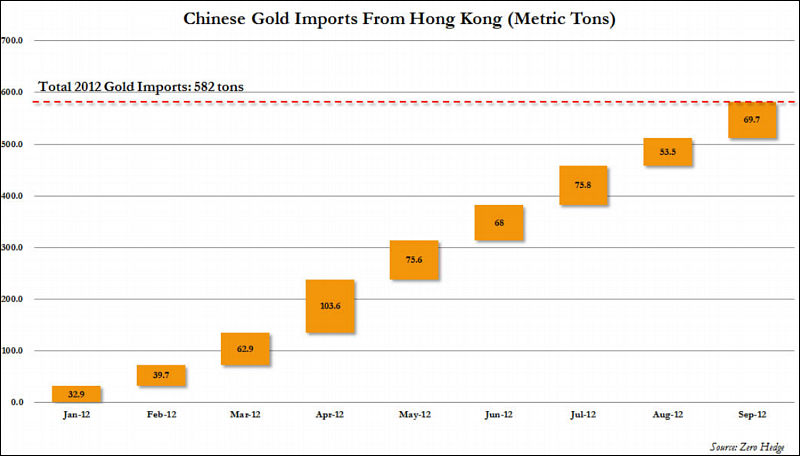

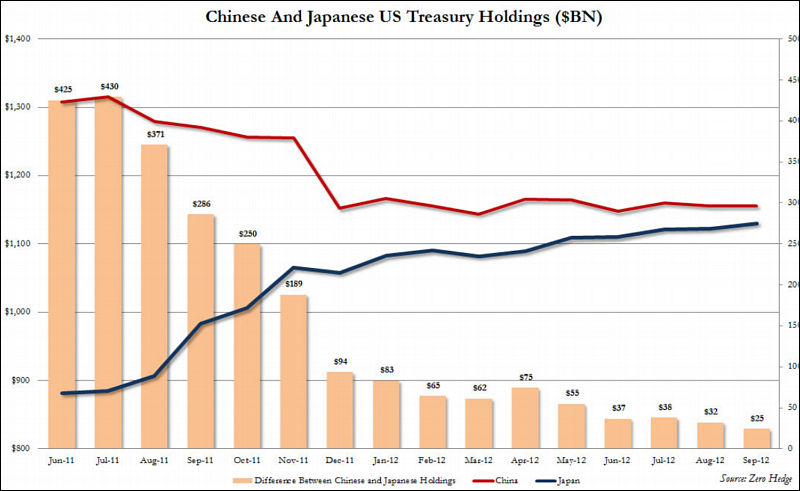

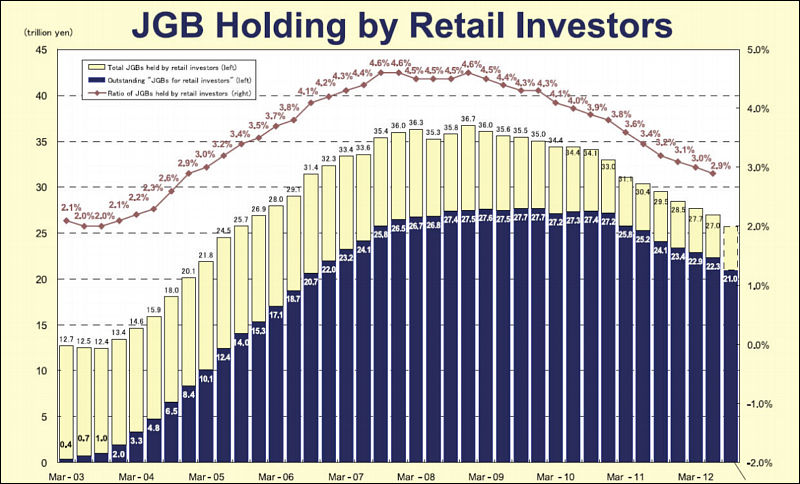

OK, it's clear that some big changes are coming soon in international debt. China is no longer investing in US dollar treasury bonds -- instead, they seem to be heavily into gold. Japan is also in some serious trouble with their debt -- and we all know that the Euro has the sick "men" of Europe, with the PIIGS (Portugal, Ireland, Italy, Greece, Spain).

This is starting to appear like a game of "pass the parcel" for debt, with the loser being.... everyone.

-

Good thing in understanding is make correction for source of information.

As ZH is run mostly on money of gold and other metals dealers and proponents.

You must be stupid to make gold your main investment, so if you turn it all into money China is mostly importing resources and knowledge and export products of it's rising inductry. Quite common for country with real sovereignty.

-

And here is country without such thing (having their head in US and UK elites):

Here you see just anti national elites in Japan example.

china.jpg800 x 491 - 66K

china.jpg800 x 491 - 66K

china1.jpg800 x 484 - 104K

china1.jpg800 x 484 - 104K -

Interesting, very interesting: I've checked and resumed the gold (fine ounce) prices in the years of recent bigger crisis (towards the end of those years, respectively) and it is VERY interesting:

1980: 589,8 $ (Afghanistan war / Iran revolution)

1997: 290,2 $ (big Asia crisis)

1998: 287,8 $ (russian bankrupt)

2001: 276,5 $ (9/11)

2008: 869,8 $ (Lehmann Bros bankrupt)

2009: 1.087 $ (big panic)

2010: 1.405 $ (Greece....)

2011: 1.531 $ (EU: Italy, Spain, Irland...)

today (Nov,19th) 1.734.30

So China either obviously fears total crash of the world finance system, or their experts see some smart idea investing in gold, which I can't see (....but I am maybe not so smart), the fact is, that it was never yet so uninteresting to invest in gold like right now. We could see possibly quite soon who was right.

-

....for us who don't have such problems like China (owning billions), we can invest in old good, very fast lenses :-)

-

Another interesting development. Foreigners (non-EU) can now buy a house in Spain, and win permanent residency. I wonder if real-estate will offer a better hedge than gold?

-

@ahbleza CNN had a story on that. 50 grand gets you a nice little place in Mallorca I think it was.

-

I wonder if real-estate will offer a better hedge than gold?

Nope, it is not "better hedge". As you need to pay taxes, clean it, etc, etc.

Real estate is not really good investment (of you are not in the housing bubble state)

-

@Vitaliy_Kiselev Maybe not a good investment.... but hopefully not losing value, which is the primary purpose of a hedge.... an offset to potential loss.

I agree that we never own land... the state owns it, and we lose it if we stop paying taxes on it.

-

Maybe not a good investment.... but hopefully not losing value

If you just look at real inflation numbers (get food, fuel, etc expanses) and compare it with charts depicting real-estate price you won't like it. In fact it is loosing value.

-

Real estate is not a bad investment. At least on Florida and Georgia states. More areas are having higher rents than mortgage payments.

Gold has commodity characteristics during the normal time. It's not easy to "trade" commodities.

-

ZH is all negative and extreme as usual :)

US bond market has a long way to go up before blowing up. Of course nothing goes up straight or down straight. But the trend seems up for the bond market.

-

Real estate is not really good investment (of you are not in the housing bubble state)

Yes, but if you ARE in a housing bubble state, you're king of the fucking universe.

-

@brianluce Until the bubble bursts... the challenge is to exit your position before that happens. The next challenge is to decide where to diversify next. I think @tetakpatak's idea of old fast primes is excellent. :-)

-

@ahbleza Nope. Primes aren't edible. SPAM on the other hand, lasts as long as primes and makes a decent snack food.

-

True. BTW, gold isn't editable either…

-

Political Europe has the euro committed suicide - the biggest mistake in 60 years - the European vision has now been burst - with korruppten political fraudsters, such as Greece, Ireland, Spain, Italy and Portugal, you can not make Europe - sorry

-

what you guys seems to miss, is there are always a bubble that can burst.

W/E it may be :

loans, Bonds, stocks, Gold price, oile price, food price, water price, currency,

Right now, the scary thing is, IF the same powers that burst the housing market bubble , can burst the gold one it seems to then become very scary scenario.

-

As I said, gold can have commodity characteristics. It's not uncommon to see 50% correction even if a particular commodity has upward long term trend. e.g. See the price of crude oil futures.

About real estate, rising rent fee and higher cost of building homes and fear of much higher interest rate and the growing population will help find housing bottom faster. Sure it could go down more. But the long term trend seems upward. You know the land is commodity. The house built on the land is commodity, too.

The greater fool theory might work against you. When you start losing on your bet, you might think you are the greater fool and start making a wrong move. I'm not saying that the greater fool theory is stupid though.

I'm hearing more people talking about gold going up up up, real estate going down down down, fools getting more dumb dumb dumb.

I'm thinking that more people are getting more extreme and this is not a good sign.

-

@brianluce

Lenses are not edible. But excellent, fast primes often don't lose their value. The prices of old, good Nikkors 6mm f/2.8 or 13mm f/5.6 multiplied since they were made- maybe kind of extreme examples, but also more "normal" primes like Nikkors 28mm f/1.4, 58mm f/1.2 (Noct-Nikkor) or so didn't lose any of the value, even after in-calculating the inflation. Sorry for mentioning Nikkors only, but I am kind of Nikon-freak since some 30 years.....I myself belive in total crash of the world financial system in less than one year from now on. And as you seem to belive in edible things, maybe it wouldn't be so bad idea to fill your garage cabinet with enough cans of food. They const next to nothing, now, and if the total crash comes, they will have the same value like gold now. But you will be glad just to have them. If no crash comes, you invested very little, and can slowly eat one by one, they last forever.... :-) LOL

-

Now Iran is importing a lot of gold from Turkey. Mostly in barter exchange for oil, since the sanctions mean they cannot use US$.

http://www.cnn.com/2012/11/29/world/meast/turkey-iran-gold-for-oil/index.html

-

China is pouring its money into building huge megacities, which are empty. Good place to shoot your next Zombie movie!

SBS Ghost Cities

Stephen S. Roach, Chairman of Morgan Stanley Asia :

China cannot afford to wait to build its new cities. Instead, investment and construction must be aligned with the future influx of urban dwellers. The “ghost city” critique misses this point entirely.

All of this is part of China’s grand plan. The producer model, which worked brilliantly for 30 years, cannot take China to the promised land of prosperity. The Chinese leadership has long known this, as Premier Wen Jiabao signaled with his famous 2007 “Four ‘Uns’” critique – warning of an “unstable, unbalanced, uncoordinated, and ultimately unsustainable” economy.

Two external shocks – first from the US, and now from Europe – have transformed the Four Uns into an action plan. Overly dependent on external demand from crisis-battered developed economies, China has adopted the pro-consumption 12th Five-Year Plan, which lays out a powerful rebalancing strategy that should drive development for decades.

http://www.project-syndicate.org/commentary/china-is-okay-by-stephen-s--roach

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319