-

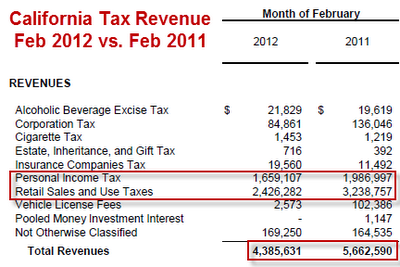

That is a 22.55% plunge in spite of the fact that this February was a leap year adding a day to the calendar

It must be clear indicator of growth, you can bet on it. As we'll see more such indicators soon.

Via: http://globaleconomicanalysis.blogspot.com/2012/03/california-tax-revenues-plunge.html

-

alcohol, cigarettes and insurance all on the rise though!!! lol.

-

There is no way Vehicle could be off by a factor of 50 that I see.

-

There is no way Vehicle could be off by a factor of 50 that I see.

It is official data. Source of this specific difference can be law change, for example, so this payments went to lower/higher level (not state).

-

Since California is always in the bag for Democratic presidents, they abuse the crap out of us. Our primaries don't even matter because they are at the end of the cycle.

-

@ Dr. Dave There is no way Vehicle could be off by a factor of 50 that I see. <<<<<<<<<<<<<

Gives me pause also.

-

Immigration has been a deliberate policy tool for government to drive down wages for corporations. This has been true for republicans and democrats, in the EU, US and Japan (though immigrant workers in Japan get treated more harshly than elsewhere). It has created a political and cultural time bomb that is going off. And underlying it is a fundamentalist view of free trade.

One of the UK's great capitalists, James Goldsmith, warned of the political long term dangers of free trade (specifically admitting over a billion workers to the labour pool from India and china). That warning was around 30 years ago. His predictions are coming true.

-

Topic fully cleared.

And it'll be last time then I allowed economic topic to go off rails in to racism and personal shouting. -

We've allowed our society to fall this far we deserve to have it taken away. We're all guilty (myself included) of allowing our lives to be controlled and manipulated and we're all guilty of voting for the guy who appears to be closest to serving our interests (in a lesser of two evils kind of way) rather than voting for who actually fully serves our interests. A hundred years ago people would have taken to the streets and threatened a civil war but now we're all so addicted to our oil, facebook, iphones etc. nobody wants to risk their "safe" bubble. It's like that cartoon where there's a plank hanging over a cliff with a politician on one end of it and a bunch of people standing around on the other - if the masses could actually act as one instead of arguing amongst themselves the whole time then perhaps something could be done. The Occupy movement was a interesting for about as long as any other tweetable viral video but people got bored with it. Whether by design or just as a natural side effect, we've all become way too self-absorbed.

-

not sure california really cares that much. They are one Facebook IPO away from having Zuckerberg's tax returns settle the books.

-

not sure california really cares that much.

They are. Just read documents.

They are one Facebook IPO away from having Zuckerberg's tax returns settle the books.

LOL. You really need some reading about principles of functioning of large corporations.

-

from WSJ (03 Feb 2012):

Buried in the registration statement of Facebook’s IPO was this startling line:

“We expect that substantially all of the net proceeds Mr. Zuckerberg will receive upon such sale will be used to satisfy taxes that he will incur upon his exercise of an outstanding stock option to purchase 120,000,000 shares of our Class B common stock.”

What that means, in dollar terms, is that Facebook founder Mark Zuckerberg may face a tax bill this year of more than $2 billion. The Financial Times puts the figure at $1.5 billion. But if the IPO values the company at the hoped-for $100 billion, his bill could be higher.

Facebook declined comment. But here’s the math. Zuckberberg received the 120 million options in 2005, presumably for being CEO and being, well, Mark Zuckerberg. Those options will be treated as ordinary income, which means he would pay the top federal income tax rate of 35%.

The cost basis for those options is six cents a share. So if the company is valued at $100 billion, and the shares are valued at around $50 each, his gain from the sale would be up to $6 billion. Taxed at 35%, the tax bill would be more than $2 billion. The FT puts a more conservative value on the company for its $1.5 billion total.

What’s more, Zuckerberg would have to pay an additional 10.3 percent for California sate taxes, though he would likely be able to deduct those taxes from his federal bill.

It’s unclear whether the $2 billion would make him America’s biggest taxpayer, since the IRS doesn’t disclose such things. But given that the 400 top earners in the U.S. paid an average of $48 million each in taxes, chances are he’ll be at least one of the biggest taxpayers in 2012 or 2013.

Mr. Zuckerberg’s tax bill will also provide an important counter-point to the notion that the rich pay lower tax rates than the rest of America. That may be true for professional investors and private-equity chiefs, but not for dot-commers and many entrepreneurs.

-

Looks like bunch of speculations pleasing to public ear. With corporations and such people you can tell that they actually paid something only after actual payment and tax deductions and returns. And believe me, this sum will be so far from $1.5 bln so you can hardly imagine.

Also take a look at whole California budgets deficites (state and local ones). It won't take long time to see that even some if fairy tale (you are talking about) will happen it won't change anything big.

-

Wow, so unfair. Zuckerberg is getting totally screwed over with that tax bill. I feel so bad for him.

-

Zuckerberg is getting totally screwed over with that tax bill

Do not worry, it is no more than journalists fantasy and speculation.

-

Just 1 percent of California taxpayers are already providing 45 percent of the state's income tax revenue. And such income taxes now fund half the budget.

But unfortunately, in recent years the number of upper-income earners in California has radically shrunk -- by a third between 2007 and 2009 alone. Apparently, wealthy Californians are either fleeing to nearby no-income-tax states or have become less well-off after years of economic downturn, higher taxes, and overregulation of business.

http://townhall.com/columnists/victordavishanson/2012/03/15/whos_to_blame_for_california/page/2

-

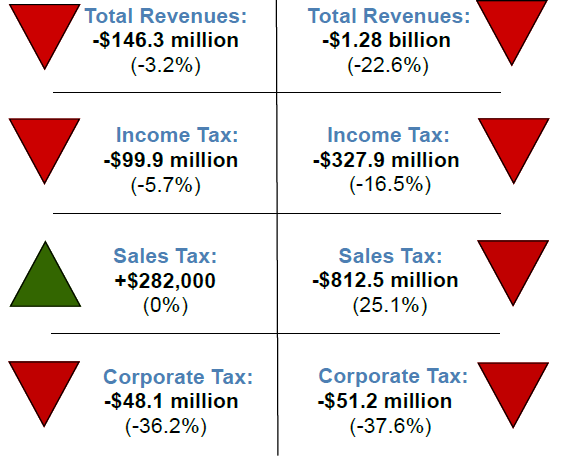

Another chart allowing top compare same period dynamic in 2011 and 2012 (both compare to same period in previous year).

calif2.png562 x 461 - 33K

calif2.png562 x 461 - 33K -

I go to college in cali and they just cut summer school, the football team, the swim team, about 30% of classes, and are suppose to be laying off a bunch of professors

-

In you look at the chart above, you'll understand that cuts will be even bigger soon.

-

What's missing from the chart above are revenues from property taxes, and that's where a huge portion of CA's income shortfall lies. The accumulated inequities of Prop. 13 is one of the biggest problems CA has to contend with today.

-

Without Prop 13, I probably could not live in California. There are those who definitely can afford it, however.

-

If you ask me, residential housing is way too high still. 900k for a 2 bedroom house? Crazy. Real estate caused the financial crisis and to me is remains an unsolved puzzle.

-

Yes, overall the state budget is not good. Especially school and social venues. In the last couple years, i would says Silicon Valley has definitely been on the upswing though. Jobs...if you have the skills/edu.

@Brian: That is not the norm. Thats way exaggerated.

-

It's the norm in Silicon Valley. In general, real estate values are far out of line with incomes.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319