-

How else do you prime a pump? Austerity has not worked. Should we try magic?

-

How else do you prime a pump? Austerity has not worked. Should we try magic?

They can try to read some books outside mainstream monetary economics. :-) Issues are fundamental, nor related to printing money or not printing money. Whole idiotism of regulating economics using money printing and credit parameters is obvious to anyone with few last working gray cells.

-

Okay I think we deserve at least one example of what you're talking about for alternative remedies. I mean you're dismissing a Nobel Prize winner and decades of established and accepted theory. Personally, I am very curious and don't ask merely to tell you that you're wrong, I am always looking for ideas out of the mainstream, but always end up back at Keynes or Hayek or some such familiar place.

-

I mean you're dismissing a Nobel Prize winner and decades of established and accepted theory.

Well, you can find many reasons in blog posts, it'll be very long explanation otherwise.

Actually NO really working theories exist in mainstream, all of them just ignore small, almost non important thing, that we live in the exponentially rising energy and resources time (and exponentially rising population due to this). Well, shit, if something become better because of energy and resources - economic theory has nothing to do with it. It is same thing as many tribes still believe that shaman can bring wind and rain. As you can check, this scammers survived for thousands of years. Why modern analogs can't do the same? OF course I hope that all of them end soon on the tree with the rope on their necks, but...

-

Krugman's views are retarded. Western Universities have been a font of Keynesian and neo-Keynesian indoctrination for decades now. Whatever that idiot says, the debt does matter.

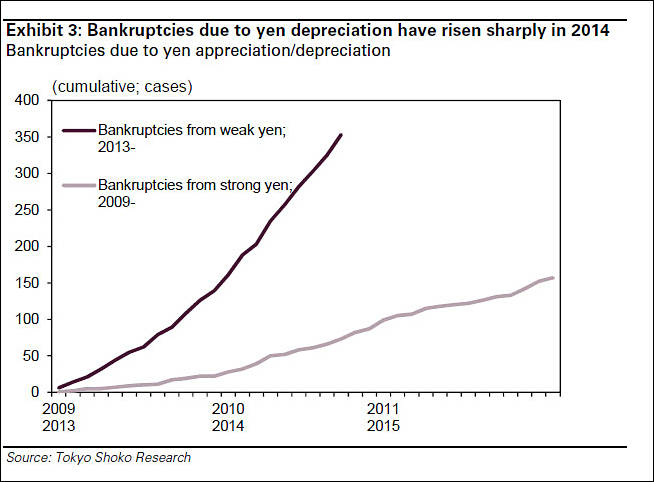

Japan is going down the plughole. They have a shrinking workforce, a shrinking tax-base, a rising elderly population that are net-spenders of Government revenue and a ridiculously high Government debt:GDP ratio. On top of that, they are governed by psychopaths intent on inflicting a 2%-at-any-cost-inflation strategy where the costs that inflicts are rising costs for their citizens on top of all those taxes he's now paying. The export benefits of yen devaluation are not materialising because their large manufacturers have relocated production to cheaper countries already.

-

Things are not pretty for ordinary citizen but not bad for camera companies.

rose9.jpg800 x 560 - 49K

rose9.jpg800 x 560 - 49K -

The sooner we stop playing monopoly the better. I think the Japanese people need a bit of poverty to recover their souls and find new purpose. Too many walk around like zombies during the day only finding moments of happiness during the weekends. I truly love the people of Japan, but their is far too much pressure on them to fit into a tiny mold and keep a stagnant routine and it is simply not healthy for the mind or body. Don't get me wrong, it is a world problem that is being worsened by governments that are doing all in their power to revert to old models without unions and without power of the people, but it seems much more set and prevalent here.

That being said, there is a wiff of optimism and renewed spirit brewing in the youth, and the hippies of the 60's are still here living long lifes and bringing back their banners. Reminds me of the US in the early 90's. Still a battle back there, and many of our hippy granny's have checked out, but many of us are stubborn in the face of dickism, if we are good for nothing else we will continue this legacy till whatever ends.

-

Media projections showed Abe's Liberal Democratic Party and its junior partner, the Komeito party, on track to win more than 317 seats in the 475-member lower house, enough to maintain its "super-majority" that smoothes parliamentary business.

Market analysts said the outcome would be positive for shares and negative for the yen.

http://www.reuters.com/article/2014/12/14/us-japan-election-idUSKBN0JR0N920141214

-

The Government Pension Investment Fund is the largest such fund in the world, managing 130 trillion yen ($1.27 trillion) in assets. In 2014, GPIF raised its target weighting of Japanese equities to 25% from 12%. And the Bank of Japan decided in late July to nearly double its annual purchases of exchange-traded funds to 6 trillion yen, as part of monetary easing.

These major public-sector buyers do not appear on shareholder lists because of their indirect ownership via trust banks and other intermediaries. But The Nikkei estimates that the two together are the largest shareholders for 474 of about 1,970 stocks on the TSE first section, based on public information.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319