Rates and idiots

-

Nouriel Roubini tweets: "I was just interviewed on CNBC:The ECB has to reverse this week its biggest mistake ever, the rate hike that sharply worsened the EZ crisis."

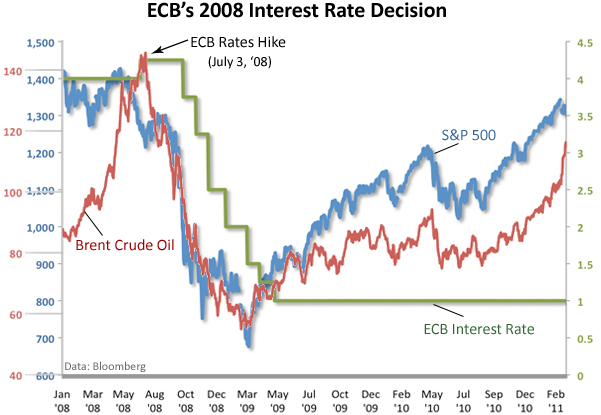

What's amazing about the ECB rate hikes earlier this year is that EVERYONE saw the possibility that it was going to turn into a disaster, in part because it so nicely echoed the blunder from 2008, when Jean-Claude Trichet -- looking at surging oil prices and a weakening banking system -- decided to hike rates in order to fight inflation.

Here's a chart we ran earlier this year, showing what the scene looked like in 2008, as Trichet hiked rates right at the top of the oil peak, only to see the whole thing collapse soon thereafter.

My personal opinion about about this rate related games and rants is as follows.

Imagine that you sit in a small black car and you are instructed to turn wheels to the right

to prevent accident with car in front of you.

You'll turn wheel accordingly, right? Wrong!

Problem is that you are standing still, and it is huge white truck going 120Mph who must turn.

So, turning wheel is fuckingly bad idea.

You better leave the car to have at least hope to survive and see letters on the side of the track - "Good luck from real economy!".

Or you can sit and continue to properly adjust rates for some time, short time:

-

@Vitaliy

Maybe title of this post should be : Rats and idiots ? ;-) ( (On the other hand, I personally like the rats ) -

Why is inflation such a bad thing? Seeing how the banksters all demonize it, I figure there must be something in it for the rest of us.

-

great metaphor!!!

-

I don't see the metaphor at all. The relationship between two cars on a collision course and inflation/interest rate relationship doesn't work, because controlling the money supply via interest rates will have some effect on inflation. In the metaphor, one car does not affect the other.

@LPowell: A little inflation isn't a bad thing, but uncontrolled high inflation is. Inflation means that your money is worth less, so imagine that instead of a loaf of bread costing $1, it now costs $2, but your salary stays the same. This eats into your buying power, it eats into business profits, and ultimately, it leads to higher interest rates which affects credit, home buying, etc. A moderate amount of inflation isn't a big deal; deflation or high inflation is generally bad.

As for the original post, raising interest rates to prevent inflation makes sense...if you actually have inflation. If you don't have serious inflation, raising interest rates is a dumbass idea. Here's a better analogy, if you're driving on the freeway and you're about the hit the car in front of you, putting the brakes on (raising the rates) is a good idea. However, if you brake just for the sake of braking, you're likely to have somebody rear-end you (e.g. an unintended negative consequence). -

@MrAnthony

Unfortunately, you got it wrong.

Huge amount of actual problems keep car still, and turning a wheel (adjusting rates) won't move the car into safe place.

But actual problems is what we have guys who are only able to turn the wheel.

It looks like they don't know even how to open the door :-) -

Except that interest rates aren't like turning a wheel; they're more like a brake/accelerator. High interest rates can act like a brake; low ones tend to act like an accelerator. But I agree: we have people who don't know how to drive.

-

>Except that interest rates aren't like turning a wheel; they're more like a brake/accelerator. High interest rates can act like a brake; low ones tend to act like an accelerator.

Nope. If you want to make such analogy you must assume that exhaust is going to the car interior, so after such "boost" you have pretty fucked atmosphere.

You can also look at this as a guy with a bare ass sitting on bumpy road and holding ropes connected to 100 chickens. He also have bunch of sunflower seeds. So, he throws them around hoping what some chickens will run for them and move him. It is always painful and effect is minimal, but it works.

Ouch, almost forgot, each chicken must return his investment in the form of shit, but it must be 2x of source food.

Current situation is as follows - most chickens are nearly dead and out of shit to pay, and few who can run don't want to eat as they are 50kg each already. And the nails on the road, how I could forgot this... :-) -

Wow, and I thought the US unemployment thread was getting strange. Exploding chickens full of....

Quite an image:-) -

>Exploding chickens full of.... Quite an image:-)

Yep. Same as most modern economies :-) They are also full of shit.

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319