It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

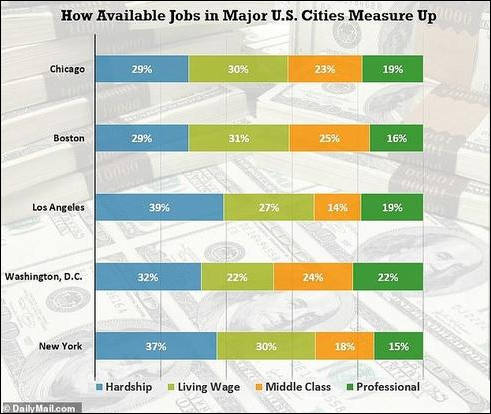

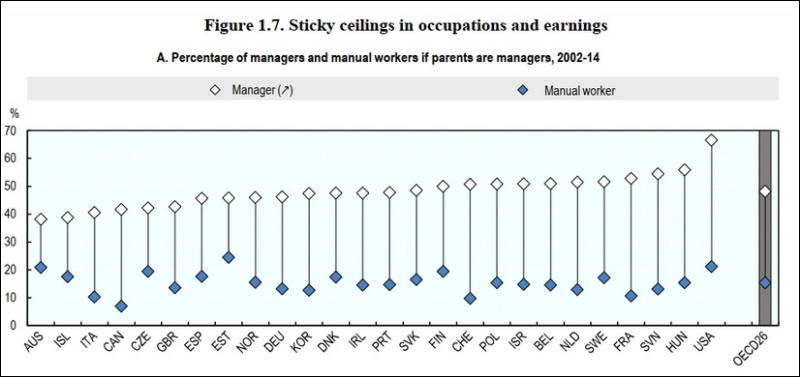

Only 28% of Americans are considered “financially healthy,” according to a CFSI survey of more than 5,000 Americans. “Financial health enables family stability, education, and upward mobility, not just for individuals today but across future generations,” the CFSI says. “Many are dealing with an unhealthy amount of debt, irregular income, and sporadic savings habits.”

Meanwhile, 17% of Americans are “financially vulnerable,” meaning they struggle with nearly all financial aspects of their lives, and 55% are “financially coping,” meaning they struggle with some but not all aspects of their financial lives. The recent volatility in the Dow Jones Industrial and S&P 500 has not helped Americans feel secure, experts say.

-

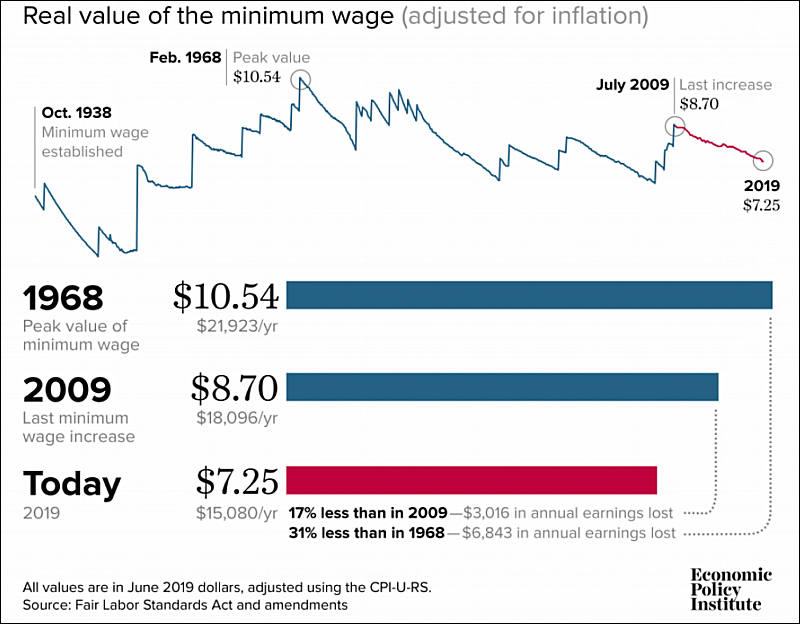

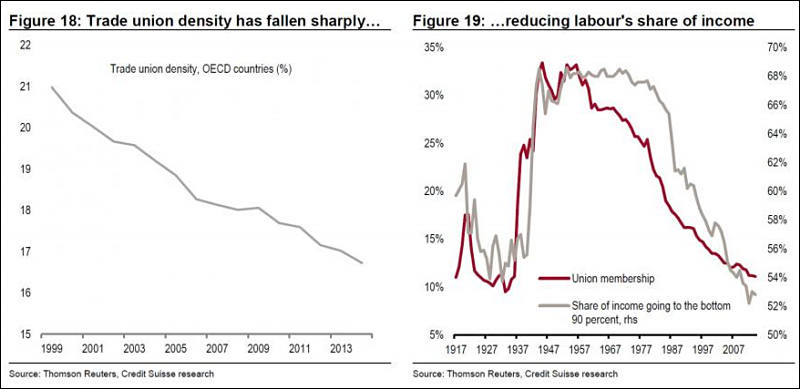

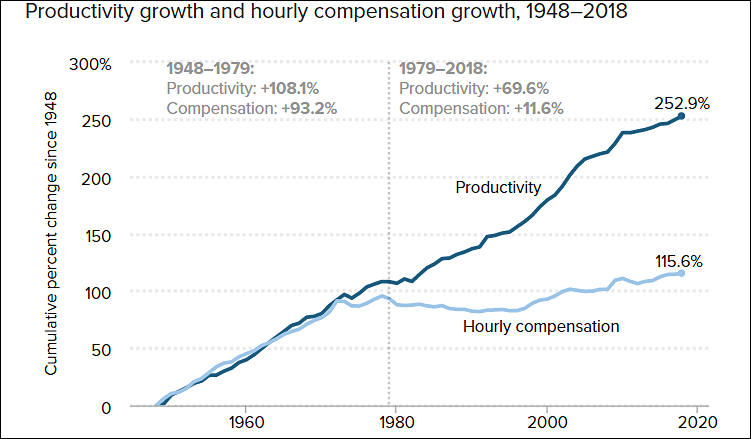

The middle class is imploding in society after society. Even the vaunted Canadian and European middle classes, better protected by generous social contracts, are beginning to decline. The working class is fast becoming something like a caste of digital serfs, roaming from on demand gig to on demand gig, scavenging the landfill of prosperity for today’s ride, task, job, detritus.

-

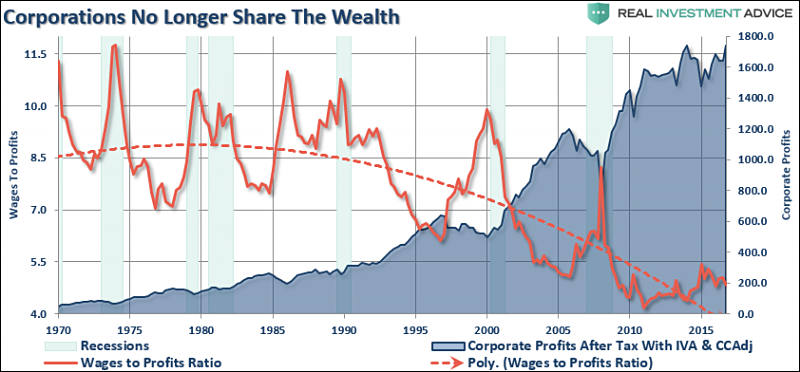

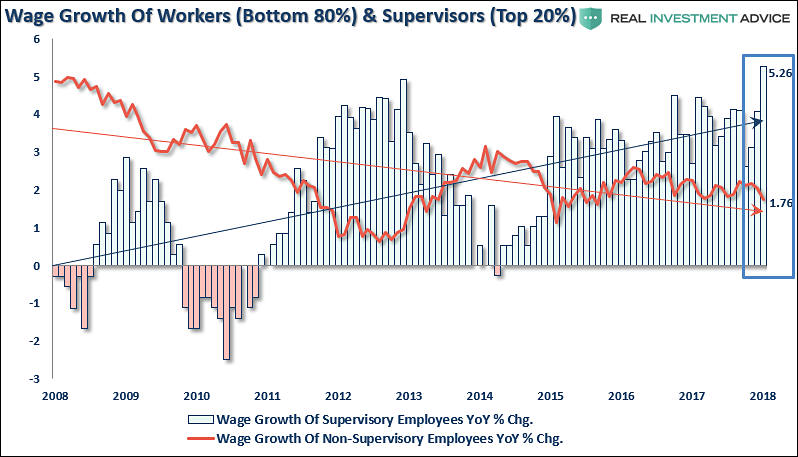

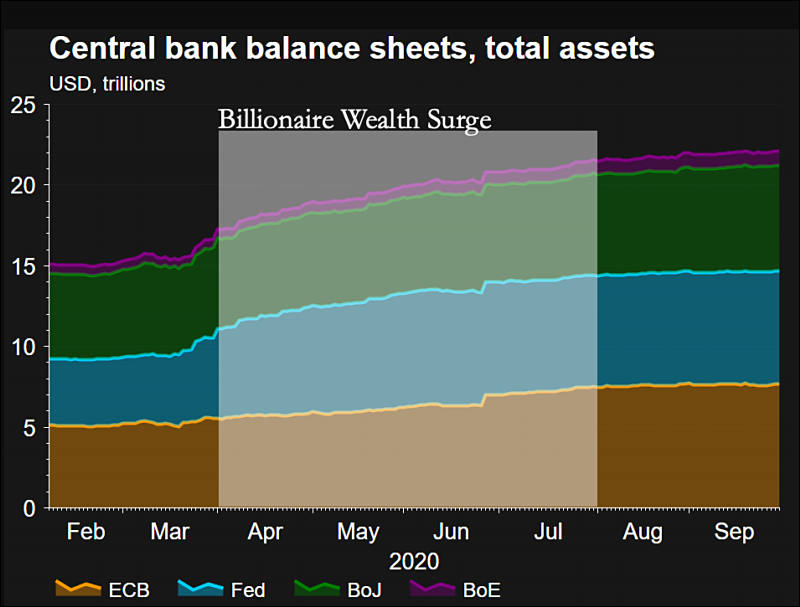

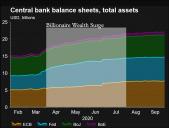

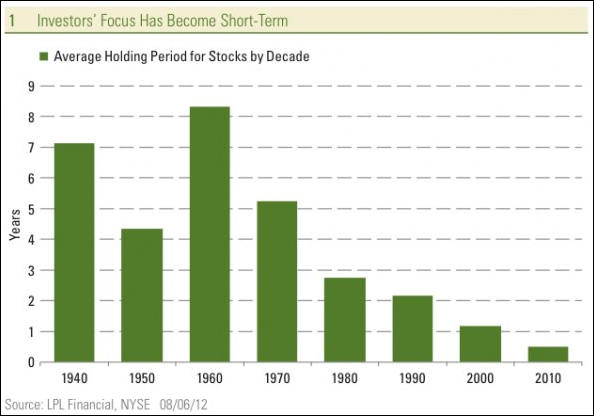

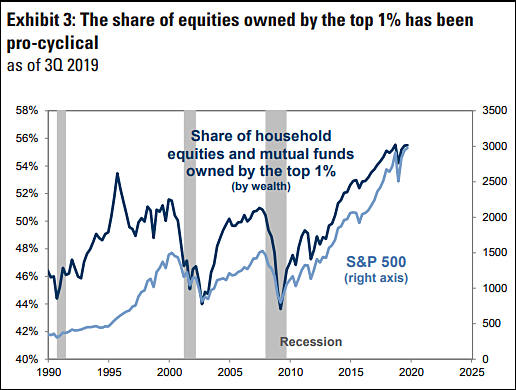

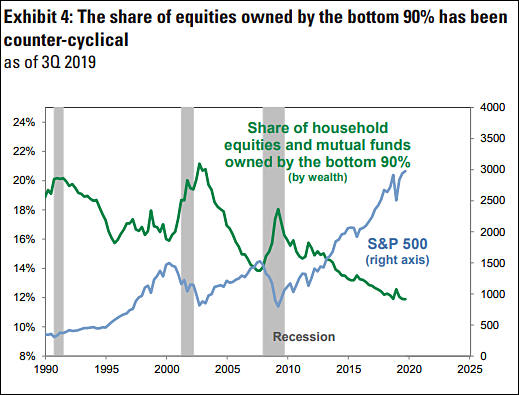

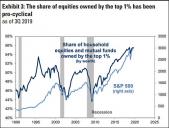

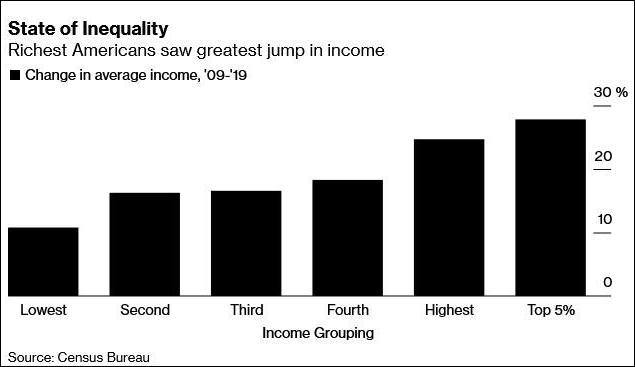

On stock market as special income redistribution machine

sa14662.jpg516 x 390 - 46K

sa14662.jpg516 x 390 - 46K

sa14663.jpg519 x 395 - 47K

sa14663.jpg519 x 395 - 47K -

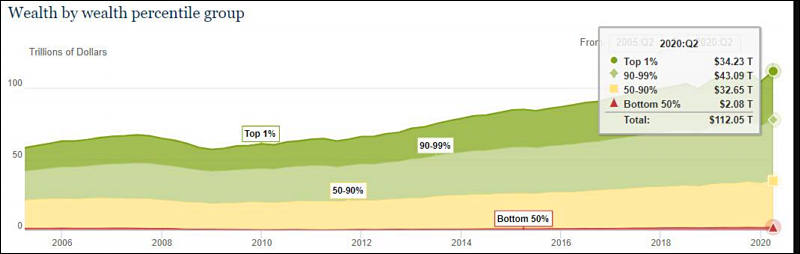

According to the latest Fed data, the top 1% of Americans have a combined net worth of $34.2 trillion (or 30.4% of all household wealth in the U.S.), while the bottom 50% of the population holds just $2.1 trillion combined (or 1.9% of all wealth).

-

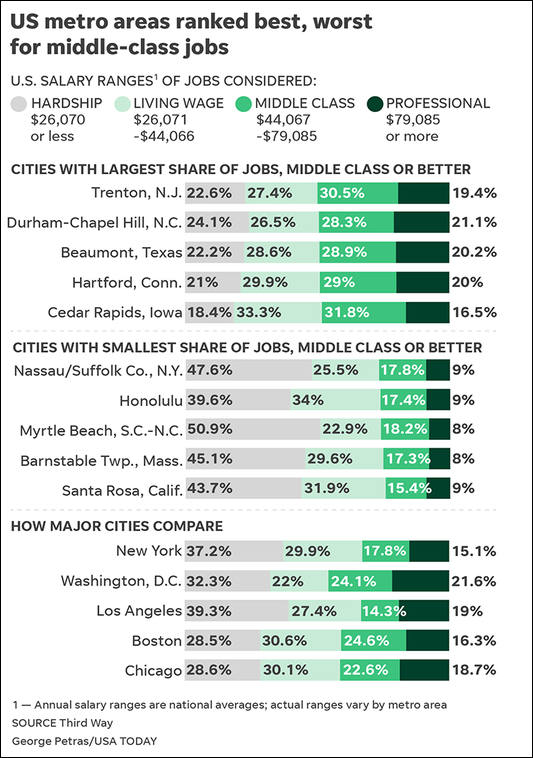

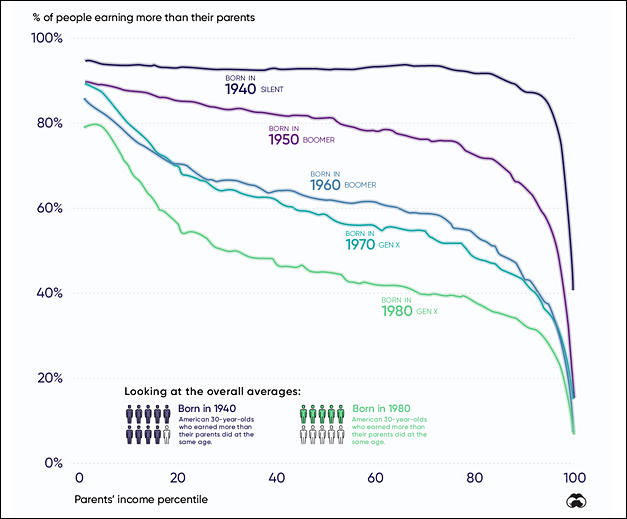

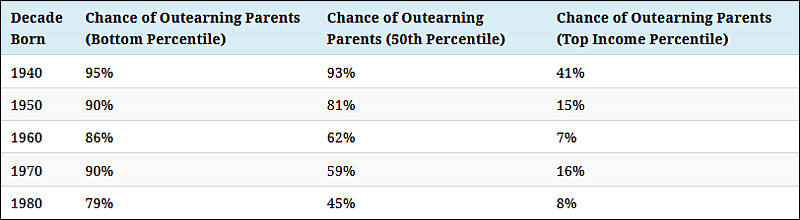

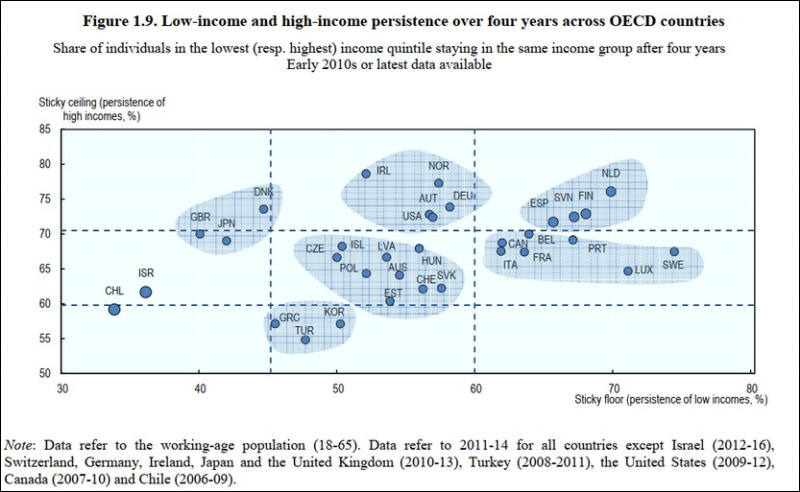

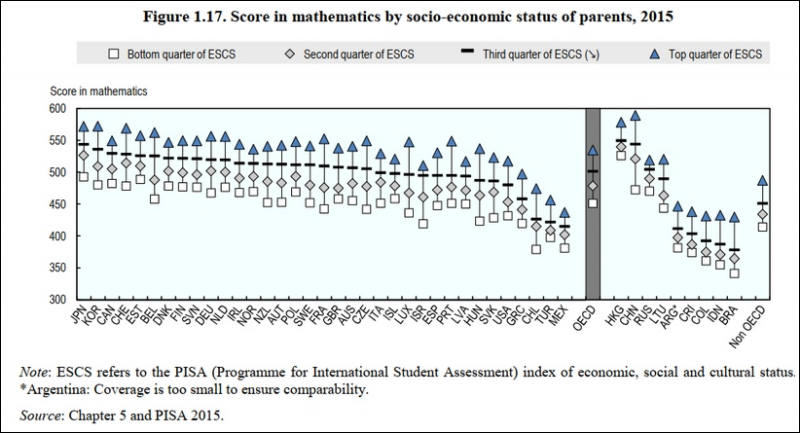

Issues with social mobility

sa15589.jpg800 x 377 - 42K

sa15589.jpg800 x 377 - 42K

sa15590.jpg800 x 436 - 62K

sa15590.jpg800 x 436 - 62K

sa15591.jpg800 x 492 - 64K

sa15591.jpg800 x 492 - 64K

sa15592.jpg800 x 433 - 57K

sa15592.jpg800 x 433 - 57K -

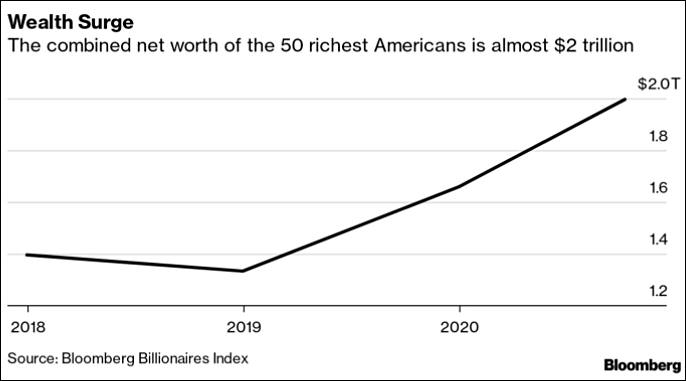

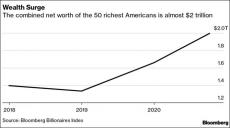

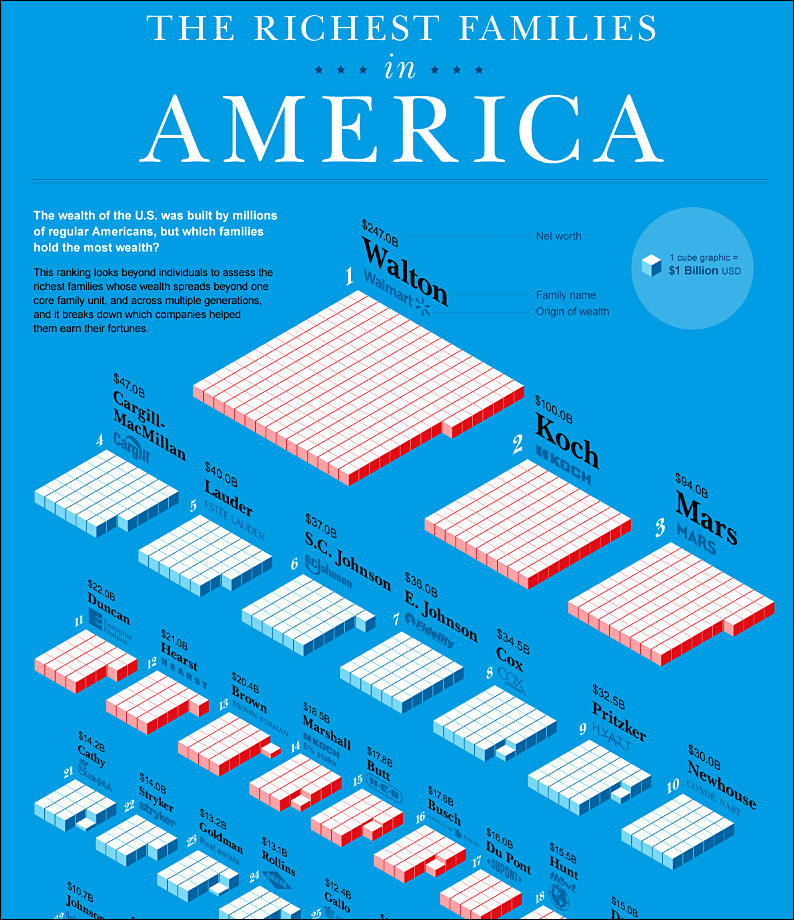

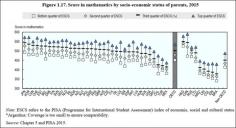

U.S. Billionaires Gained $1 Trillion Since The Pandemic Started

sa15711.jpg744 x 683 - 88K

sa15711.jpg744 x 683 - 88K -

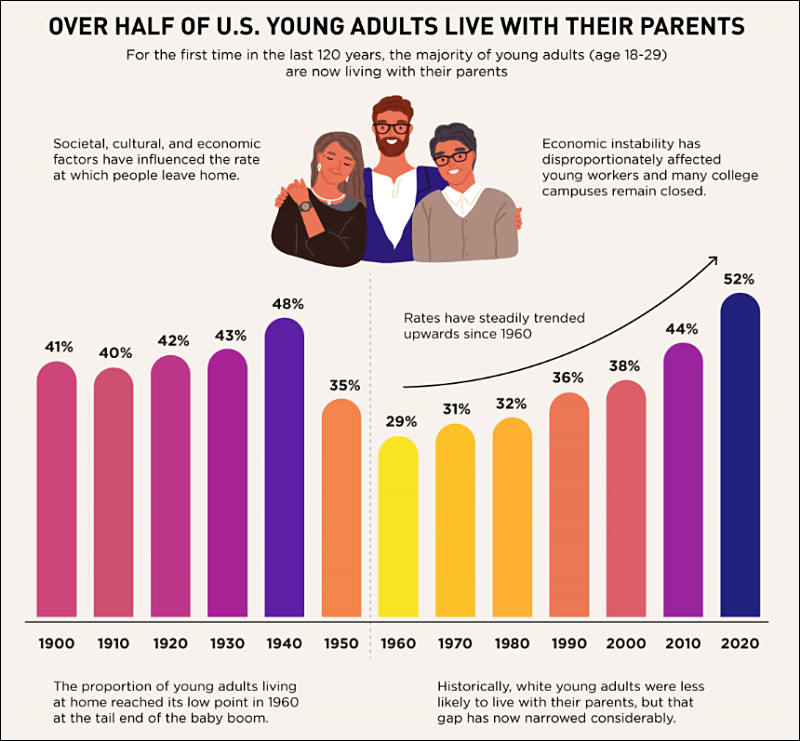

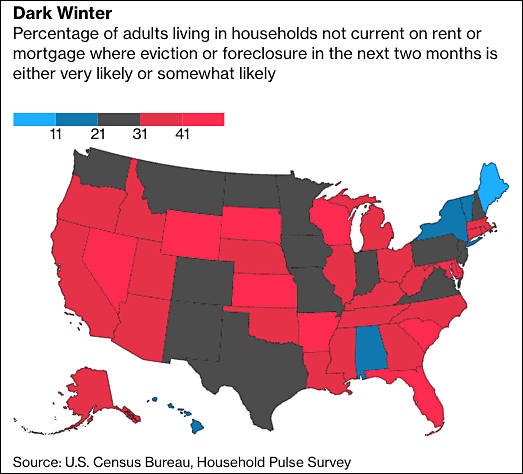

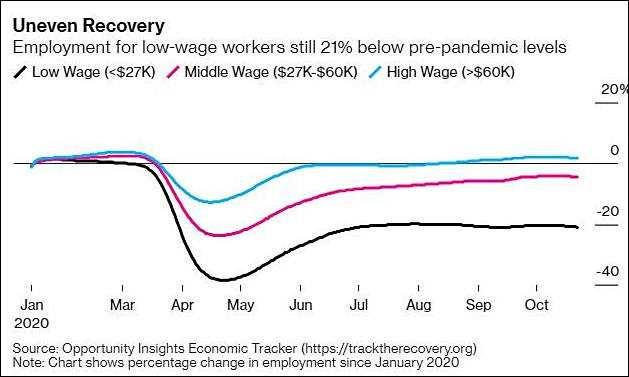

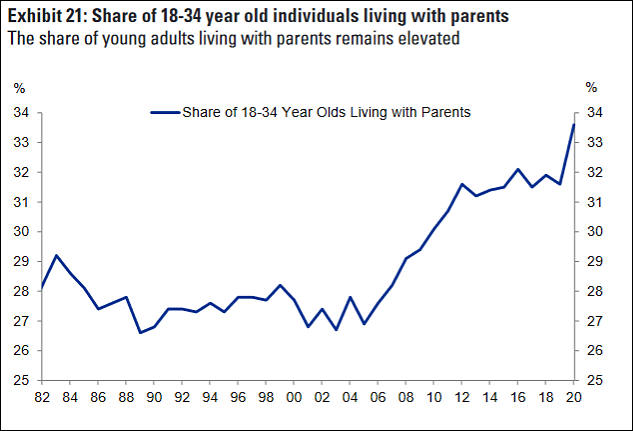

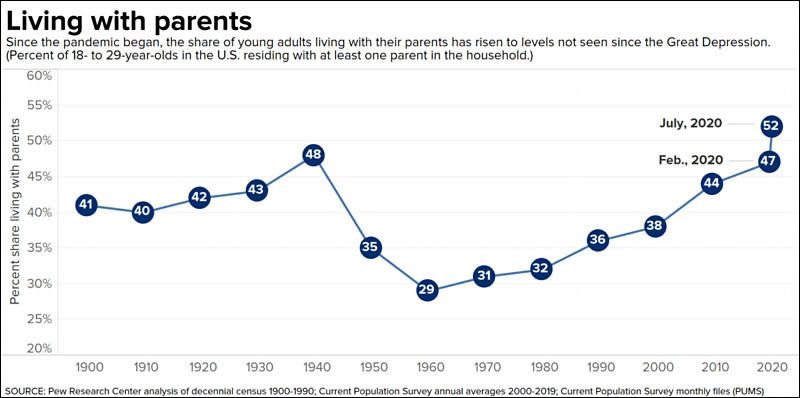

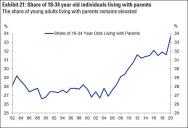

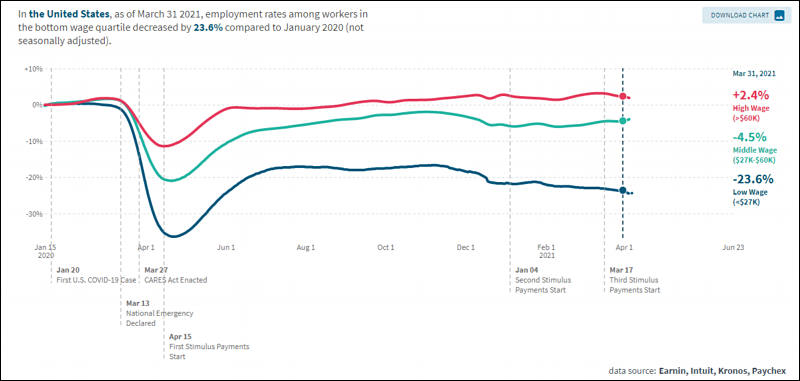

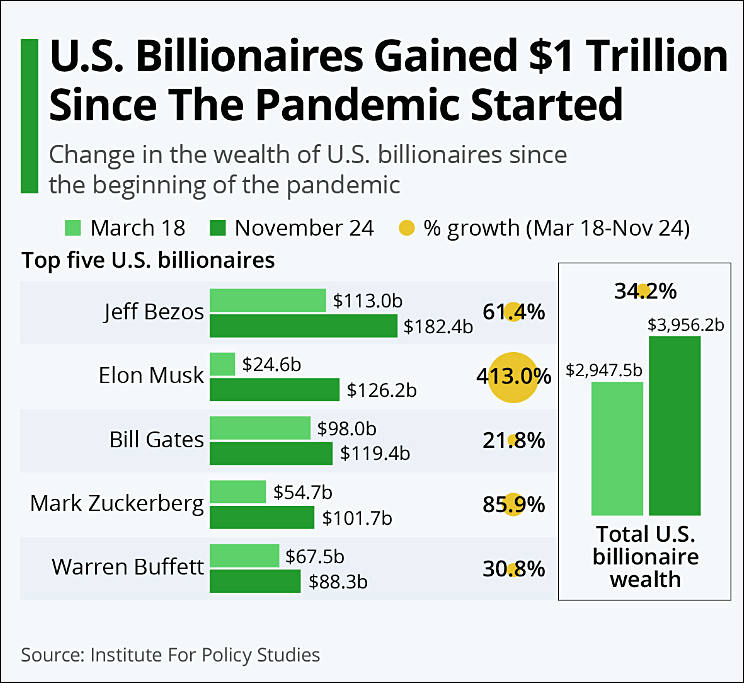

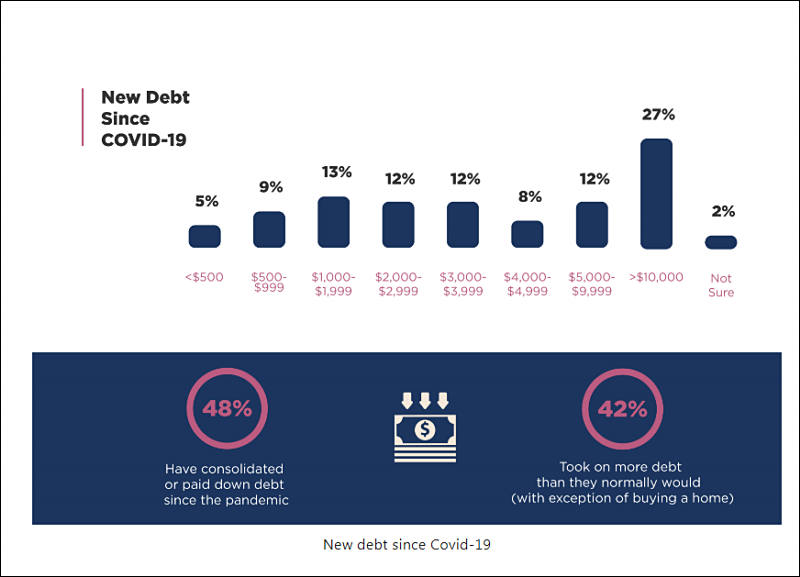

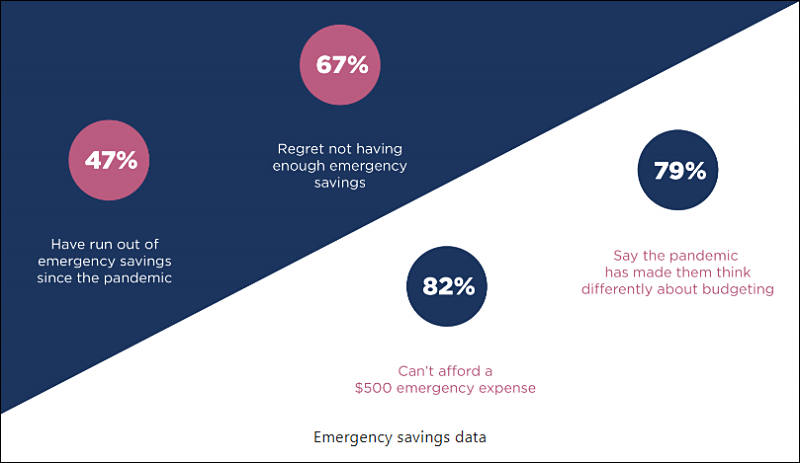

COVID made big dent in the middle class life

sa15756.jpg780 x 756 - 48K

sa15756.jpg780 x 756 - 48K

sa15757.jpg800 x 577 - 44K

sa15757.jpg800 x 577 - 44K

sa15758.jpg800 x 463 - 37K

sa15758.jpg800 x 463 - 37K -

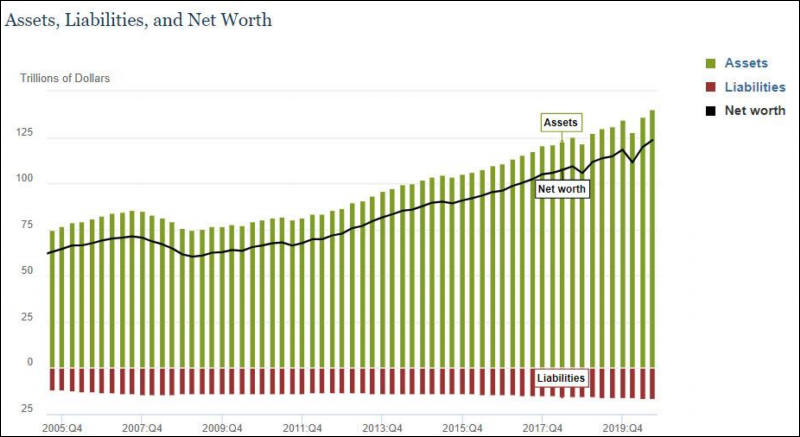

Middle class mostly holding due to another bubble on housing market

sa15802.jpg635 x 367 - 26K

sa15802.jpg635 x 367 - 26K

sa15801.jpg800 x 437 - 57K

sa15801.jpg800 x 437 - 57K -

sa16882.jpg794 x 920 - 195K

sa16882.jpg794 x 920 - 195K -

In 2020, the energy per capita was about 279 million Btu, which is worse not only in 1995 (343 million Btu), but even 1970 (324 million Btu). The current level corresponds to about the mid-60s.

And Biden wants to lower it at least by 30-40%. To the 20s-30s times.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319