It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

I bought about $1.25 worth of BTC back in 2014-2015. I wonder how much that would be worth now. Not gonna dig out that passport/save file unless it'd make me rich.

-

Issue with such investments is that they do not have any fundamentals, so if next month main media will be asked to crash bitcoin to $0.1 they will do so instantly. And it'll be aligned with all main exchange points blocking. Previous bubble had been stopped using similar approach, but light version, they closed and busted only around 20-30% of points.

-

I don't consider them investments. I just snarkily wanted to learn what is my BTC position worth now. As I was educating myself about blockchain, I installed a wallet and made the minimum purchase allowed at the time.

Investment is when Bill Gates buys farmland with soon to implode fiat currency. OTOH government money isn't real either, but at least it can be temporarily used as a means of exchange.

-

Investment is when Bill Gates buys farmland with soon to implode fiat currency.

Bill Gates just makes wrong assumption about private property on means of production, including land. Staggering error.

-

@Vitaliy_Kiselev they're just prepping for Feudalism 2.0, after all it worked the first time around. Meanwhile you're a bigger marxist than Lenin. Cheers.

-

they're just prepping for Feudalism 2.0, after all it worked the first time around. Meanwhile you're a bigger marxist than Lenin.

Nope no such thingy as Feudalism 2.0 will happen, only Fascism 1.01 can.

I am more modern Marxist, but much more stupid. :-)

-

This time it is serious as can delay hyperinflation by few months

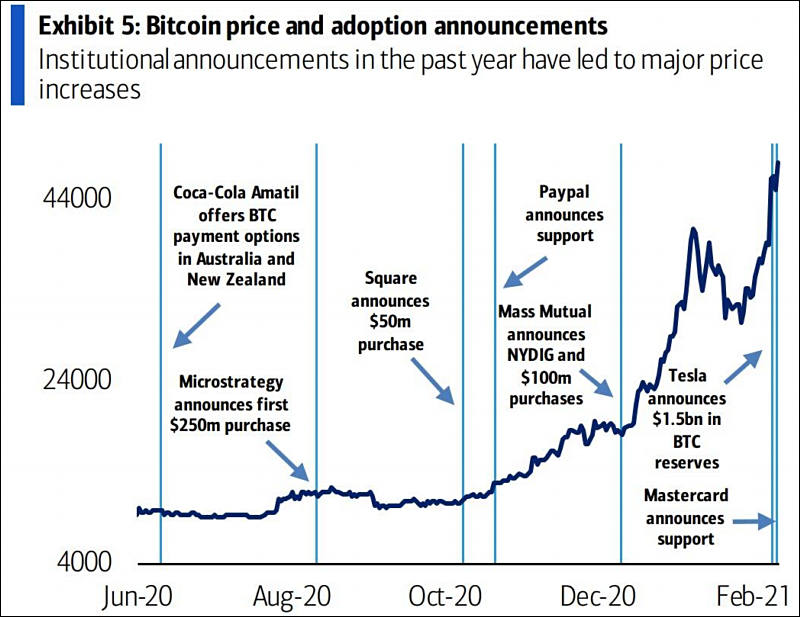

Whatever your opinions on cryptocurrencies — from a dyed-in-wool fanatic to utter skeptic — the fact remains that these digital assets are becoming a more important part of the payments world.

We are seeing this fact play out on the Mastercard network, with people using cards to buy crypto assets, especially during Bitcoin's recent surge in value. We are also seeing users increasingly take advantage of crypto cards to access these assets and convert them to traditional currencies for spending.

We are preparing right now for the future of crypto and payments, announcing that this year Mastercard will start supporting select cryptocurrencies directly on our network. This is a big change that will require a lot of work. We will be very thoughtful about which assets we support based on our principles for digital currencies, which focus on consumer protections and compliance.

-

Few guys working in usual big information (not tech related) holding told that crypto currency news are now required item. This means that they need to write something nice for hamsters almost daily and write how nice is to invest in bitcoin now.

-

Large corporations are beginning to look closely at cryptocurrencies not only as a tool for investment, but also as a means of payment. According to representatives of the US Securities Commission (SEC), it is high time to adopt transparent rules for the circulation of cryptocurrencies in this area, which would allow attracting a "new generation of investors" to the market.

These remarks were made in an interview with Reuters by Hester Pierce, representing the interests of the aforementioned US federal agency. Previously, she has repeatedly spoken out in favor of the spread of cryptocurrencies, and with the coming to power in the country of a new team, the moment for establishing a legislative framework for the cryptocurrency market comes, in her opinion.

The interest of corporations in this instrument and means of payment underlines the need for early adoption of transparent and understandable rules for the circulation of cryptocurrency assets, according to Pierce. Attracting more participants to the market, in her opinion, will contribute to healthier pricing.

-

FT article

A little over 100 years ago, there was a bubble asset that rose and fell wildly over the course of a decade. People who held it would have lost 100 per cent of their money five different times. They would have, at various points, made huge fortunes, or seen the value of their asset destroyed by hyperinflation.

The asset I’m referring to is gold priced in Weimar marks. If this reminds you of bitcoin, you are not alone. In his newsletter Tree Rings, analyst Luke Gromen looked at the startling similarities in the volatility of gold in Weimar Germany and bitcoin today. His conclusion? Bitcoin isn’t so much a bubble as “the last functioning fire alarm” warning us of some very big geopolitical changes ahead.

I agree. Central bankers have over the past 10 years (or the last few decades, depending on where you put the marker) quashed price discovery in markets with low interest rates and quantitative easing. Whether you see this as a welcome smoothing of the business cycle or a dysfunctional enabling of debt-ridden businesses, the upshot is that it’s now very difficult to get a sense of the health of individual companies or certainly the real economy as a whole from asset prices.

The rise in popularity of highly volatile cryptocurrencies such as bitcoin could simply be seen as a speculative sign of this US Federal Reserve-enabled froth. But it might better be interpreted as an early signal of a new world order in which the US and the dollar will play a less important role.

The past four years of Donald Trump’s presidency and his toxic politics have taken a toll on the world’s trust in America. That has also diminished trust in some quarters about the dollar’s stability as the global reserve currency. This feeling reached an apex during the January 6 attack on the US Capitol building. As financial policy analyst Karen Petrou put it in a recent note to clients: “There are many casualties of this quasi-coup, but the US dollar may well be among them. It’s no more immortal than any other category-killer brand.”

Trump certainly devalued Brand USA. But he is also a symptom of longer-term economic problems in the US — problems which have in recent years been papered over by low rates and monetary policy, which kept asset prices high but also encouraged debt and leverage.

Bitcoin’s rise reflects the belief in some parts of the investor community that the US will eventually come in some ways to resemble Weimar Germany, as post-2008 financial crisis monetary policy designed to stabilise markets gives way to post-Covid monetisation of rising US debt loads. There are, after all, only three ways out of debt — growth, austerity, or money printing. If the US government sells so much debt that the dollar starts to lose its value, then bitcoin could conceivably be a safe haven.

Germany’s currency debasement didn’t end well. This underscores another aspect of the bitcoin boom. We have moved from a unipolar world in which the US was the pre-eminent political and economic power, to a post-neoliberal world where there is no longer a consensus in favour of free trade and unfettered capitalism. We will probably have two or even three poles — the US, Europe and China.

China has signalled its desire to become less dependent on the US financial system, buying fewer US Treasuries and rolling out its own digital currency. In this world, it is easy to imagine that the dollar would continue to be the main reserve currency, with the renminbi and the euro gradually becoming more important stores of value. But one can also imagine that cryptocurrencies that can easily cross borders would have some advantages over fiat money issued by governments. While the migration of people and goods may become more constrained, digital trade and information flows are still growing.

Crypto advocates including technology leaders such as Tesla’s Elon Musk, Facebook’s Mark Zuckerberg and Twitter’s Jack Dorsey believe that digital currencies are better suited to this more multipolar world. They are largely unregulated and thus less subject to political forces. In the same way that large technology platforms recently demonstrated their power by removing Trump from social media, bitcoin could conceivably float above any currency nationalism that might result from the new world order.

Will cryptocurrency become the new gold — a hedge against a changing world? Will the Big Tech consensus prove more powerful than either the Washington consensus or the Beijing consensus? Perhaps. But it’s also possible that sovereign states will move to regulate this existential threat. In the US, Treasury Secretary Janet Yellen has already raised the issue of future cryptocurrency regulation.

None of this makes me want to buy bitcoin. But I also don’t see it as a normal bubble. It was unclear at the beginning of the 20th century which of the hundreds of automakers would win the race to replace the horse and buggy. Now, who knows whether bitcoin, ethereum, or diem, or some yet-to-be-invented digital currency will win out long term. For now, the bitcoin boom may best be viewed as a canary in the coal mine.

Crypto currencies are not only state controlled bubble, but they became terrorist weapons as they promote wasting huge amount of energy (and note, NONE, 0% of green protectors of ecology have courage to tell you this!)

-

On February 19, the capitalization of bitcoin for the first time in history reached $ 1 trillion, according to CoinDesk. The cryptocurrency reached $53.7 thousand. Since the beginning of the month, the capitalization of the bitcoin rose by $400 billion.

Nice, lot of hamsters will suffer with hundreds of billions lost.

-

Handelsblatt: Mr. Ehrhardt, bitcoin is now widely discussed in the markets with opposite views. This cryptocurrency is 50 times more expensive today than it was four years ago. But last week it lost a fifth of its value

Jens Eckhardt: Bitcoin could be the biggest speculative bubble of all time. One gets the impression that there is some kind of gigantic system operating here, similar to the distribution of "letters of happiness." This is possible because central banks around the world have triggered an unprecedented flood of liquidity.

Don't you look too gloomily at what is happening? Many believe that cryptocurrencies are part of a technological revolution that will change the entire financial industry.

One can only wonder that central banks allowed such a phenomenon to arise. Indeed, within its framework, there is a movement of large volumes of unofficial money outside the state and tax services. Even criminals are now extorting money in bitcoins.

-

Companies like CoinFlip and Coin Cloud have installed "thousands" of the ATMs across the country, according to Reuters. Coin Cloud has 1,470 machines around the United States and is aiming for 10,000 by the end of 2021.

There's currently 28,185 bitcoin ATMs in the United States. About 10,000 of those have popped up over the last 5 months, the report notes.

This guys are serious.

-

PayPal’s new “Checkout with Crypto” allows users to instantly convert their Bitcoin, Ethereum, Litecoin, or Bitcoin Cash to US dollars.

As usual, paypal take part in any grand scam.

-

Signal announced on Tuesday it’s now testing a new peer-to-peer payments system in the beta version of its apps. Appropriately called Signal Payments, the new feature right now supports only one protocol: the MobileCoin wallet and its companion cryptocurrency MOB. MobileCoin has a close relationship with Signal co-founder and CEO Moxie Marlinspike.

Finally CIA pet toy outing.

-

In mid-February, Tesla invested $ 1.5 billion of free funds in Bitcoin. At the last quarterly conference, it turned out that operations with bitcoin allowed Tesla to receive $101 million in net income.

In other words, Tesla scammed people for big amount of money, stealing the services and goods that they could get. Criminals.

-

EBay CEO Jamie Iannone did not rule out that in the future, the online auction platform will begin to accept payments in cryptocurrency. It is worth noting that more and more companies are starting to accept payments in cryptocurrency. For example, the American company Tesla accepts bitcoins as payment for electric vehicles, and PayPal has added features to its service that allow customers to buy, sell and store digital assets using their own online wallets.

“We are always looking for the most suitable forms of payment and will continue to evaluate them in the future. We have no plans for the near future, but the cryptocurrency is what we are watching, "- quotes the source of the words of the representative of eBay.

In an interview with CNBC, eBay CEO Jamie Iannone confirmed that the company is considering adopting digital currencies. He also noted the company's interest in entering the NFT market and announced that options for putting this into practice are currently being considered.

Bad news for all of us.

-

All working fine

Cryptocurrency has hit a significant milestone: It’s now worth more than all US dollars currently in circulation.

Cryptocurrencies hit a valuation of $2 trillion on April 29, according to The Wall Street Journal. That’s about the same valuation as all US dollars in circulation. However, it has since hit as high as $2.25 trillion — and in the process actually exceeding dollars in circulation.

-

Sales of PC peripherals, CPUs and motherboards are expected to be impacted by second-hand mint products offloaded by cryptominers in the second half of 2021, according to sources from the PC DIY channel.

This is dangerous rumors as can only mean that we will see crash soon.

-

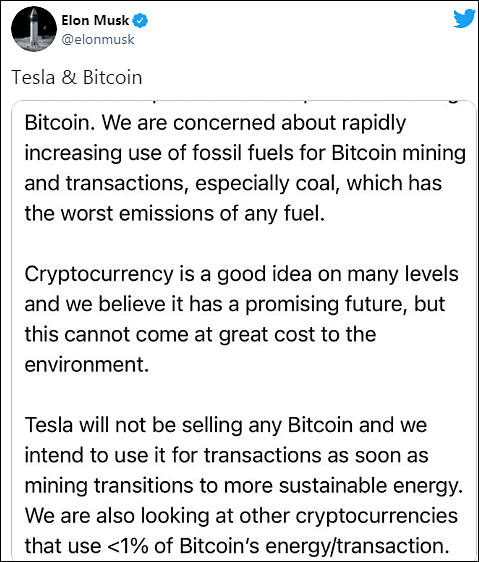

After announcing plans to accept payment for Tesla's cars in bitcoin back in February, Tesla CEO Elon Musk has just announced via tweet that the company will suspend bitcoin payments over concerns about the environment.

First steps followed.

sa17245.jpg479 x 562 - 61K

sa17245.jpg479 x 562 - 61K -

The Justice Department and the IRS have launched an investigation into the world's largest cryptocurrency exchange, Binance Holdings Ltd, amid a recent cyberattack on Colonial Pipeline Co. that caused severe fuel shortages on the east coast of the United States

The big change of direction I sense here.

-

The three associations under the People's Bank of China (PBC) have issued a joint notice prohibiting companies from supporting cryptocurrency-related businesses. This was announced by journalist Colin Wu.

The document referred to by Wu is signed by the China Banking Association, the Internet Finance Association and the Payment Clearing Association. They recommended that citizens refrain from investing in cryptocurrencies and reminded that such operations are not protected by law.

“Digital currency is a special virtual commodity that is not associated with monetary authorities. It has no monetary properties and is not real currency. It is prohibited to use it as a medium of exchange on the market, ”the notice says.

The measure is aimed at reducing the risks of speculation with cryptocurrency. The companies were required to stop any activity related to digital assets and break off cooperation with specialized players. In particular, Internet platforms were banned from displaying relevant advertisements.

The associations will strengthen their oversight of market participants. Violators will be sanctioned.

-

It seems that China has listened to Nouriel Roubini, the most ardent critic of the technology. I fully agree with Nouriel and have been a skeptic since I first learned of bitcoin a decade or more ago. I'm amazed at how much it has grown and wish that I bought Ether when it was single dollars, but oh well, at least I didn't contribute to the insane coal use.

-

Bitcoin and similar tools play very important rule.

It is modern version of gold rush and even more close to lottery.

It makes people to believe into fairy tale that you can be nice and rich without doing anything useful.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,970

- Blog5,724

- General and News1,346

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras117

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319