It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

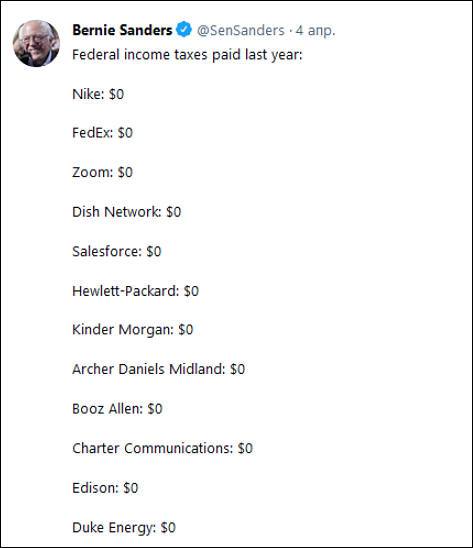

Profits and taxes paid by some corporations (or more correctly said, to some corporations) :-)

Back in 1950, corporate taxes accounted for about 30 percent of all federal revenue. In 2012, corporate taxes accounted for less than 7 percent of all federal revenue.

General Electric

- U.S. Profits: $10,460,000,000

- Taxes Paid: ‐$4,737,000,000

PG&E Corp.

- U.S. Profits: $4,855,000,000

- Taxes Paid: ‐$1,027,000,000

Verizon Communications

- U.S. Profits: $32.518.000.000

- Taxes Paid: ‐$951,000,000

Wells Fargo

- U.S. Profits: $49,370,000,000

- Taxes Paid: ‐$681,000,000

American Electric Power

- U.S. Profits : $5,899,000,000

- Taxes Paid : ‐$545,000,000

Pepco Holdings

- U.S. Profits: $882,000,000

- Taxes Paid: ‐$508,000,000

Computer Sciences

- U.S. Profits: $1,666,000,000

- Taxes Paid: ‐$305,000,000

CenterPoint Energy

- U.S. Profits: $1,931,000,000

- Taxes Paid: ‐$284,000,000

NiSource

- U.S. Profits: $1,385,000,000

- Taxes Paid: ‐$227,000,000

Duke Energy

- U.S. Profits: $5,475,000,000

- Taxes Paid: ‐$216,000,000

Boeing

- U.S. Profits: $9,735,000,000

- Taxes Paid: ‐$178,000,000

NextEra Energy

- U.S. Profits: $6,403,000,000

- Taxes Paid: ‐$139,000,000

Consolidated Edison

- U.S. Profits: $4,263,000,000

- Taxes Paid: ‐$127,000,000

Paccar

- U.S. Profits: $365,000,000

- Taxes Paid: ‐$112,000,000

Integrys Energy Group

- U.S. Profits: $818,000,000

- Taxes Paid: ‐$92,000,000

Wisconsin Energy

- U.S. Profits: $1,725,000,000

- Taxes Paid: ‐$85,000,000

DuPont

- U.S. Profits: $2,124,000,000

- Taxes Paid: ‐$72,000,000

Baxter International

- U.S. Profits: $926,000,000

- Taxes Paid: ‐$66,000,000

Tenet Healthcare

- U.S. Profits: $415,000,000

- Taxes Paid: ‐$48,000,000

Ryder System

- U.S. Profits: $627,000,000

- Taxes Paid: ‐$46,000,000

El Paso

- U.S. Profits: $4,105,000,000

- Taxes Paid: ‐$41,000,000

Honeywell International

- U.S. Profits: $4,903,000,000

- Taxes Paid: ‐$34,000,000

CMS Energy

- U.S. Profits: $1,292,000,000

- Taxes Paid: ‐$29,000,000

Con-way

- U.S. Profits: $286,000,000

- Taxes Paid: ‐$26,000,000

Navistar International

- U.S. Profits: $896,000,000

- Taxes Paid: ‐$18,000,000

DTE Energy

- U.S. Profits: $2,551,000,000

- Taxes Paid: ‐$17,000,000

Interpublic Group

- U.S. Profits: $571,000,000

- Taxes Paid: ‐$15,000,000

Mattel

- U.S. Profits: $1,020,000,000

- Taxes Paid: ‐$9,000,000

Corning

- U.S. Profits: $1,977,000,000

- Taxes Paid: ‐$4,000,000

FedEx

- U.S. Profits: $4,247,000,000

- Taxes Paid: $37,000,000 (a rate of less than 1%)

Total

- U.S. Profits: $163,691,000,000

- Taxes Paid: ‐$10,602,000,000

Earlier this month, the Facebook Inc. released its first “10-K” annual financial report since going public last year. Hidden in the report’s footnotes is an amazing admission: despite $1.1 billion in U.S. profits in 2012, Facebook did not pay even a dime in federal and state income taxes.

Instead, Facebook says it will receive net tax refunds totaling $429 million.

-

Oh I can't wait to do my taxes this year! New tax bracket! Fun times I tell you, fun times.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,981

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319